What these $1,000–$2,000 IRS refunds are

Starting in 2026, certain taxpayers may receive one-time IRS refunds in the $1,000–$2,000 range. These refunds stem from federal tax rule changes and targeted credits lawmakers implemented for the 2025 tax year, payable in 2026.

This article explains who is likely to qualify, the expected payment timeline, and steps you can take now to prepare. Use this guide to estimate your eligibility and avoid delays.

$1,000–$2,000 IRS Refunds Coming in 2026: Who qualifies

Qualification generally centers on income, filing status, and specific tax credits. The new refunds are structured as refundable credits, so eligible low- and moderate-income taxpayers may receive the full amount even if they had no tax liability.

Key qualifying factors include:

- Adjusted Gross Income (AGI) thresholds set by law for 2025 tax year returns.

- Filing status: single, head of household, or married filing jointly may have different limits.

- Dependents and child-related credits that increase the refund amount.

- Prior-year tax credit carryovers or eligibility for earned income tax credit (EITC) enhancements.

Income limits and typical scenarios

Exact income limits vary based on the final IRS guidance and legislation. Generally, full refunds target taxpayers with AGI under a specified threshold, with phased reductions up to a higher cap.

Common scenarios that may qualify include:

- Single taxpayers with low wages who claimed the EITC.

- Families with qualifying children who received enhanced child-related tax benefits.

- Older adults or disabled taxpayers who meet adjusted income criteria.

How the $1,000–$2,000 IRS refunds are calculated

The payments are calculated as refundable credits on your 2025 tax return. The IRS will determine the refund after your return is processed and after matching eligibility criteria against income, dependents, and prior credit claims.

Factors that affect the final amount include prior payments, withheld taxes, and interactions with other credits. If the credit exceeds your tax liability, the excess is refunded to you as a direct payment.

Examples of calculation

- If a single filer qualifies for a $1,200 refundable credit and has $0 tax liability, they receive the full $1,200 as a refund.

- If a married couple qualifies for a $2,000 refundable credit but owes $300 in other taxes, their net refund will be adjusted accordingly before payment.

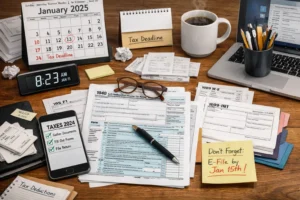

Payment timeline for refunds arriving in 2026

Payments are tied to the 2025 tax filing season. Here is the typical timeline to expect:

- January–April 2026: Tax returns for the 2025 tax year are filed.

- IRS processing: Most refunds that include the new credit will be processed within weeks to a few months, depending on volume and verification steps.

- Direct deposit is fastest; paper checks take longer.

If your return requires additional verification, expect longer processing and later payment dates. The IRS may send letters to request documentation, which will pause payment until resolved.

How to speed up your refund

To reduce delays, file electronically, choose direct deposit, and ensure all personal information matches Social Security records. Respond promptly to any IRS notices and keep copies of income documents and proof of dependents.

Refunds tied to new refundable credits are often delayed the first year as the IRS updates systems for verification and fraud prevention. Filing accurately and early reduces the chance of extra review.

Documentation and filing tips for 2025 returns

Gather W-2s, 1099s, Social Security numbers for all dependents, and records of any government benefits. Keep proofs that support dependent claims, such as school or medical records if requested.

If you use a tax preparer or software, confirm it supports the new credit and that you enter all required details. Mistakes in names, SSNs, or bank info are common causes of delay.

What to do if you get an IRS notice

Read notices carefully, follow instructions, and provide documents quickly. Do not ignore letters — unresolved issues will delay payments and may require appeals or additional filings.

Real-world example: How one family received $1,500

Case study: The Garcia family, two parents with one child, had an AGI of $38,000 for 2025. They claimed the new refundable credit and existing child tax measures.

After filing electronically with direct deposit, the IRS calculated a $1,500 refundable credit. Because their tax liability was low, they received the full $1,500 refund via direct deposit six weeks after filing.

This example shows how filing method, accurate records, and qualifying income levels can lead to prompt payment of the full refund amount.

What to watch for and next steps

Keep an eye on IRS announcements and the official guidance for the 2025 tax year. Congress or the IRS could adjust eligibility or payment procedures before refunds are issued.

Action steps:

- Collect 2025 tax-year documents now to make filing faster.

- File electronically and choose direct deposit for speed.

- Check the IRS website for the latest eligibility details and AGI thresholds.

Frequently asked questions

Will everyone get the full $1,000–$2,000? No. The full amount depends on eligibility, income levels, and interactions with other credits.

When will I get the money? Refunds are expected after the IRS processes 2025 tax returns in 2026. Timing varies by filing method and verification requirements.

Staying informed and organized is the best way to benefit from these refunds. Prepare your documents now and consult a tax professional if your situation is complex.