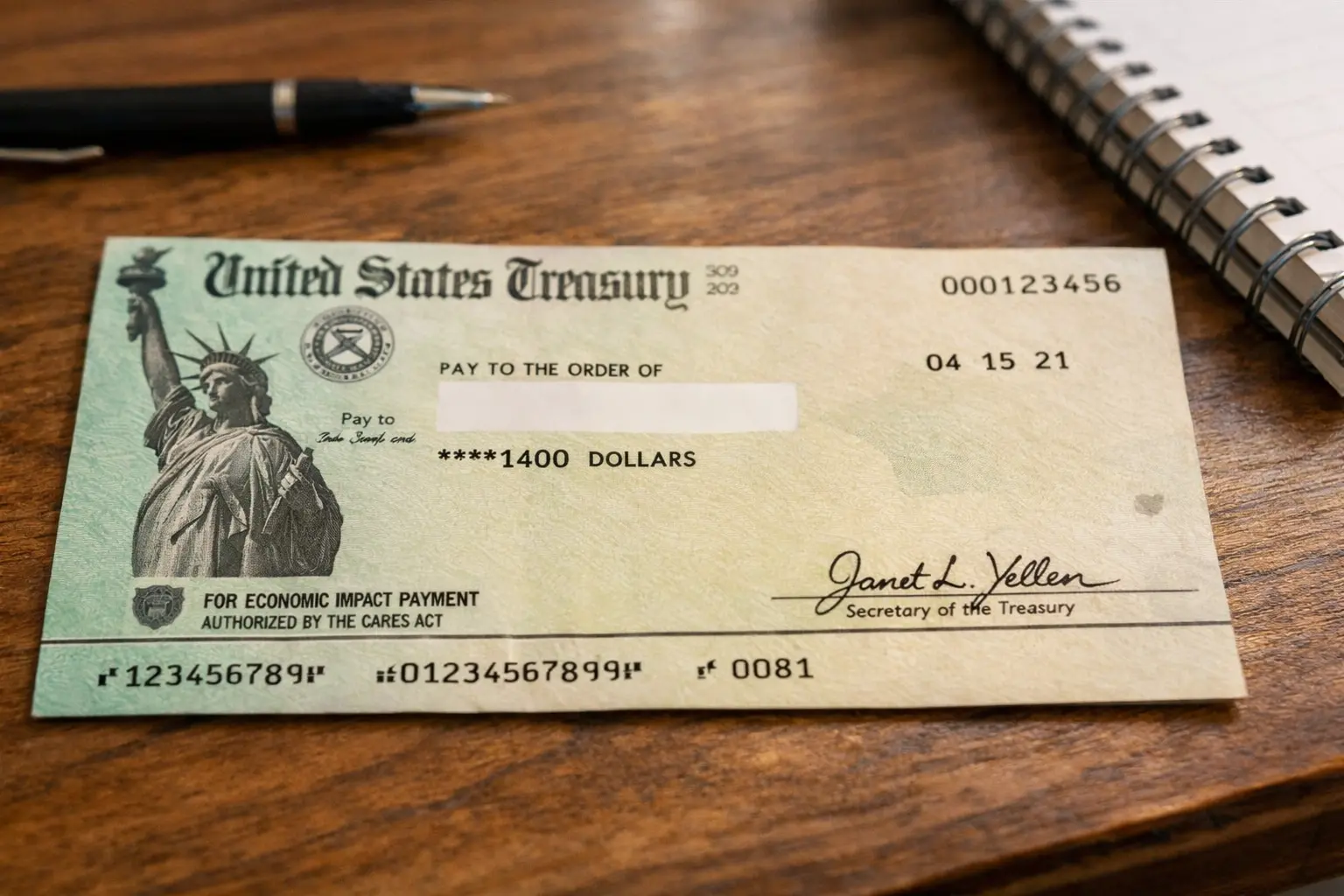

The federal tax landscape for early 2026 includes a planned IRS deposit of $2000 for certain eligible taxpayers. This guide explains who can expect the payment, how eligibility is determined, the scheduled payment windows, and practical steps to confirm or correct your status.

IRS $2000 Deposit February 2026: Eligibility Criteria

Eligibility for the IRS $2000 deposit depends mainly on filing status, income thresholds, and qualifying dependents. The IRS will use the most recent tax return or information on file to determine who receives the funds.

Basic eligibility factors include:

- Adjusted Gross Income (AGI) below specified limits for single, head of household, and joint filers.

- Valid Social Security Number for the taxpayer (and qualifying dependents where applicable).

- Not claimed as a dependent on another person s return.

- Not a nonresident alien for the tax year used to determine eligibility.

Income thresholds and phaseouts

Most programs with fixed payments use phaseouts to reduce or eliminate payments for higher incomes. Expect the IRS to apply a sliding reduction above the primary AGI limit. Exact thresholds will be published by the IRS and may use the most recent tax return year available.

Example phaseout behavior:

- Full $2000 for single filers under the AGI cap.

- Partial payment for incomes moderately above the cap, reduced by a set percentage.

- No payment for incomes well above the upper limit.

IRS $2000 Deposit February 2026: Payment Periods and Timeline

The IRS will distribute payments in one or more batches in February 2026. Typical timelines include initial deposits by direct deposit and later mailed checks or debit cards for people without direct deposit on file.

Expected payment schedule:

- Early February: First direct deposits go out to taxpayers with current banking information on file.

- Mid to Late February: Additional direct deposits based on updated returns or corrected records.

- Late February into March: Paper checks and prepaid debit cards mailed to addresses on file.

Keep in mind that mail delivery and processing can add days or weeks to the receipt of paper payments.

How the IRS decides who goes in each batch

The IRS typically prioritizes payments where it already has verified direct deposit details and no outstanding processing issues. Returns requiring manual review or identity verification are often scheduled for later batches.

How to Confirm Eligibility and Check Payment Status

Use official IRS tools to verify your payment status. The IRS will publish a payment portal or update the Get My Payment tool when distributions begin.

Steps to check status:

- Visit the official IRS website and look for the payment or economic impact information page.

- Use the Get My Payment or equivalent portal with your Social Security number, birthdate, and ZIP code.

- Check your latest tax return for errors or mismatches that could delay payment.

What to update if information is wrong

If your banking or address details are outdated, update your IRS account or file an amended return if needed. For direct deposit issues, deposit reversal, or identity verification flags, follow IRS instructions to resolve the issue quickly.

Special Cases and Exceptions

Certain groups require extra attention because of status rules or program interactions. Understanding these exceptions helps avoid surprises.

- Dependents: If someone is claimed as a dependent, they are typically ineligible for an individual payment.

- Mixed-status households: Nonresident spouses may affect joint filers eligibility; consult IRS guidance.

- SSI and SSDI recipients: Federal benefit recipients often have streamlined processes, but timing may differ.

- Incarcerated individuals and deceased taxpayers: These statuses generally disqualify automatic deposits.

What if you think you were wrongly excluded?

If you believe you were eligible but did not receive the deposit, you may be able to claim the amount as a credit on your 2026 tax return. Keep documentation showing your eligibility period and interactions with the IRS.

The IRS often uses the most recent tax return on file to determine eligibility. Filing or updating your 2025 return early can speed up qualification for 2026 deposits.

Practical Steps to Prepare for the IRS $2000 Deposit

Taking a few actions now helps ensure you receive any payment quickly and avoids delays or errors.

- File your most recent tax return on time and accurately.

- Make sure your Social Security number and dependent information are correct.

- Keep your address and direct deposit details current in your IRS account.

- Monitor official IRS announcements and use the Get My Payment tool when available.

Example: How this worked for a family

Case study: Maria, a single parent, filed her 2024 return early and had direct deposit on file. When the February 2026 deposit occurred, she received the $2000 in the first batch. Her neighbor, who had not updated a changed bank account, received a mailed check three weeks later after calling the IRS to update her information.

This illustrates that timely filing and correct banking details can speed receipt of funds.

Final Notes and Where to Get Help

Expect official, detailed guidance from the IRS as the payment date approaches. Rely only on IRS.gov for final rules and tools, and beware of scams claiming to speed up payments for a fee.

If you need help, contact the IRS through the official phone numbers or consult a tax professional for complex situations. Keep records of communications and confirmations for your files.