Some taxpayers are seeing alerts about a $1,390 direct deposit from the IRS. If you received a bank notice or an IRS message mentioning this amount, it could be a legitimate payment or a scam trigger. This guide explains how the IRS $1,390 direct deposit alert works, who may qualify, what steps to take, and how to act quickly to protect or claim money.

How the IRS $1,390 Direct Deposit Alert Works

The IRS sends direct deposits for refunds, credits, and corrected payments. A $1,390 deposit can come from an amended tax return, a correction to a previously filed return, or qualifying tax credits that were finalized after processing.

Not every taxpayer will see this exact amount. Payment amounts depend on personal tax situations such as income, filing status, and refundable credits.

Common payment sources that could equal $1,390

- Adjusted refunds after amendments or error corrections.

- Refundable tax credits like portions of the Earned Income Tax Credit or Additional Child Tax Credit.

- Catch-up or corrected payments from prior filing years.

Who Might Qualify for the IRS $1,390 Direct Deposit

There is no universal list of recipients for a specific dollar amount, but common qualifiers include taxpayers who:

- Filed an amended return that increased their refund.

- Were eligible for refundable credits that were underpaid or delayed.

- Had an income change or dependent status change processed after initial filing.

To see if you qualify, review your tax account and recent filings, including any amendments or IRS notices you received.

How to check your IRS account and payment status

- Use the IRS Online Account at IRS.gov to view payment history and notices.

- Check the “Where’s My Refund” tool if you recently filed a return for that tax year.

- Review any IRS letters you received by mail — they often explain adjustments.

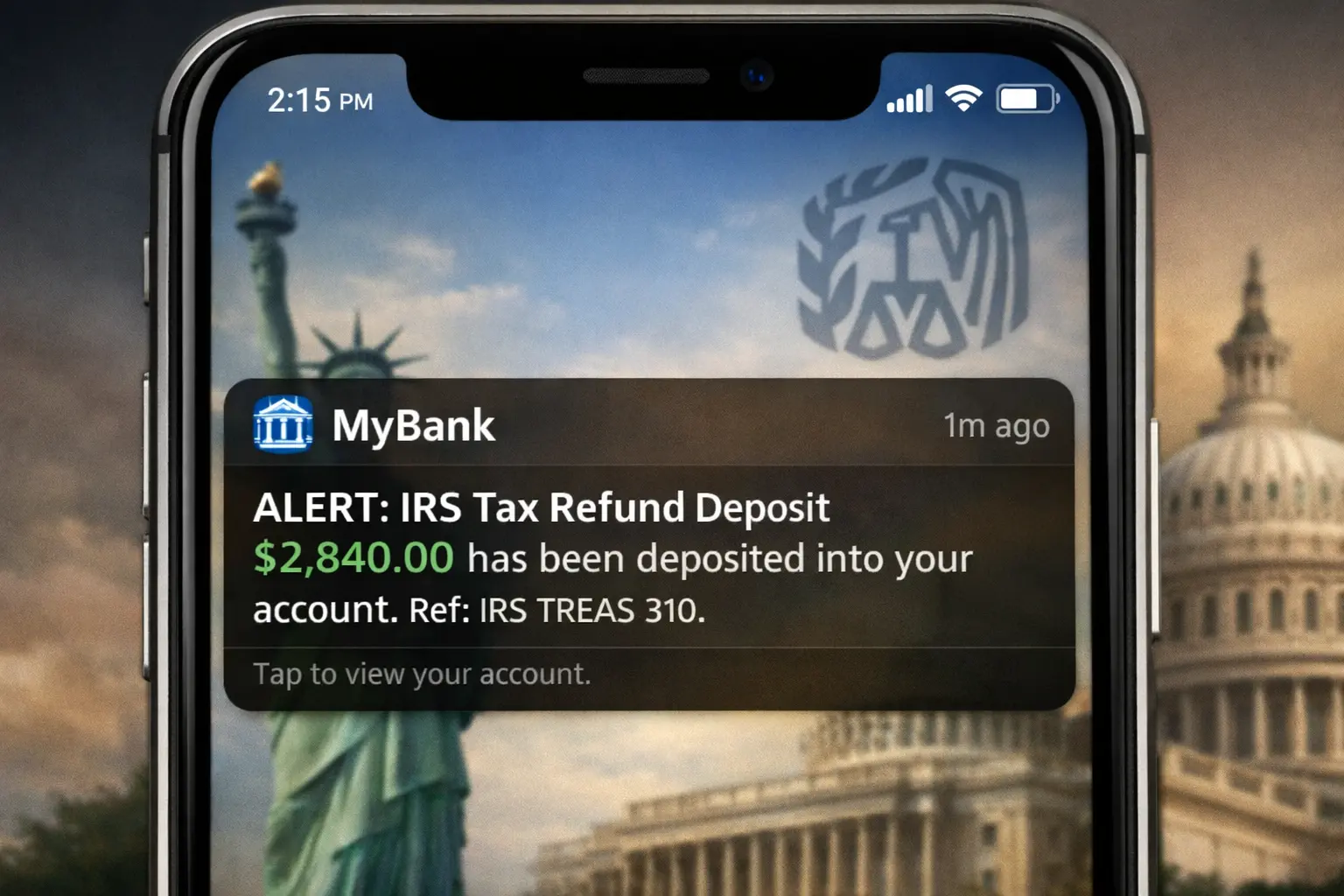

Immediate Steps to Take If You See an Alert

If your bank shows a $1,390 deposit or you received an alert, follow these steps immediately to verify and protect your funds.

- Verify the deposit: Confirm the deposit origin in your bank statement. Look for “IRS” or the Treasury reference, but remember descriptions can vary.

- Check your IRS account: Log in at IRS.gov and view recent payments or notices linked to your account.

- Save official mail: If the IRS sent a letter, keep it. Letters explain the reason for payments and instructions.

- Do not provide personal information: The IRS will not request passwords or bank info by email or text. If asked, treat it as a scam.

What to do if you think the deposit is wrong

If you did not expect the deposit or suspect an error, do not spend the money. Contact the IRS or your tax professional for guidance. If the deposit is clearly fraudulent, notify your bank immediately and file a report with the Treasury Inspector General for Tax Administration (TIGTA).

How to Claim or Fix an IRS Payment You Think You Qualify For

If you believe you qualify but have not received a payment, these practical steps can help you pursue the funds.

- Confirm eligibility: Recheck tax returns for claimed credits and your filing status.

- File or amend a return: If you missed a refundable credit, file an original or amended return. The refund statute typically allows claiming refunds within three years of the original return date.

- Provide correct banking info: If you used direct deposit, ensure your bank account and routing numbers were correct on your filed return.

- Consult a tax professional: For complicated cases, a CPA or enrolled agent can advise on amended returns and deadlines.

The IRS offers an online account where you can see payment history, balances, and notices. Setting up an account speeds verification and helps you spot unexpected deposits faster.

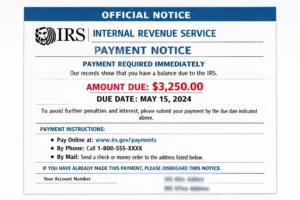

Signs of a Scam Versus a Legitimate IRS $1,390 Direct Deposit

Scammers mimic IRS alerts to get bank details. Knowing the difference helps you avoid losing money or personal data.

- Scam signs: Unsolicited texts or emails asking for bank info, urgent pressure to click links, or requests for payment via gift cards.

- Legitimate signs: Official IRS letters by mail, deposits that match your tax records, and information available in your IRS online account.

When in doubt, do not respond to suspicious messages. Instead, check your IRS account or call the IRS at the number on IRS.gov.

Small Real-World Example

Case study: Maria filed a 2023 return and later realized she qualified for an additional refundable credit after correcting her dependent status. She filed an amended return and received a $1,390 direct deposit two months later. Maria saved the IRS notice and verified the payment using her IRS online account, which matched the bank deposit. She kept records and contacted her tax preparer to confirm no further action was needed.

When to Seek Professional Help

Contact a tax professional if you face any of the following:

- Confusing notices or unexplained payments.

- Need to file an amended return and you are unsure which form to use.

- Suspected identity theft or fraudulent deposits into your account.

A professional can help file corrections, respond to IRS notices, and protect your tax identity.

Bottom Line

If you received an IRS $1,390 direct deposit alert, verify it through your bank statement and IRS online account. Keep official IRS mail, avoid sharing personal details, and act quickly if you suspect error or fraud.

Check eligibility, file or amend returns if needed, and consult a tax professional for complex situations. Quick verification and careful records are the best ways to handle unexpected IRS deposits.