Overview of the 2000 Direct Deposit IRS Update

The IRS has announced that eligible recipients may begin receiving a one-time $2,000 direct deposit starting February 18. This update affects people who meet specific eligibility criteria and whose banking information is on file or has been updated in time.

This article explains eligibility rules, what to check now, and step-by-step actions to help you prepare for and track the payment.

Who is eligible for the $2,000 payment?

Eligibility will depend on the specific program the IRS is administering. Typically, eligibility is based on income, filing status, prior tax returns, or benefit enrollment.

Common eligibility checkpoints include:

- Filing a recent federal tax return (usually 2022 or 2023).

- Meeting income thresholds set by the IRS for the payment.

- Having valid direct deposit information on file with the IRS or Social Security Administration.

Key documents and records to verify

Before the payment date, make sure you have access to these records. They help confirm eligibility and speed troubleshooting.

- Most recent federal tax return (adjusted gross income details).

- Social Security or SSA benefit statements, if applicable.

- Bank routing and account numbers you used on your last tax return.

Payments Begin February 18 — What that means

‘Payments begin February 18’ means the IRS will start processing direct deposits on that date. Processing may take several days, and individual delivery depends on banking systems and weekends.

Expect timing like this:

- Direct deposit typically posts within 1–3 business days after IRS processing.

- Paper checks or mailed alternatives can take several weeks longer.

- If your banking info is missing or incorrect, the IRS may mail a check instead.

Immediate steps to take now

Take these actions as soon as possible to reduce delays and confirm you will receive the payment by direct deposit.

- Check IRS.gov for the official announcement and program details. Use official IRS tools only.

- Verify your most recent tax return information and bank account details used on that return.

- Create or log into your IRS Online Account to review direct deposit and mailing info.

- If you receive Social Security or other federal benefits, verify your SSA online account information.

- Keep an eye on your bank account for deposits beginning Feb 18 and allow 3 business days for processing.

How to update bank info if needed

If you need to update routing or account numbers, the IRS typically accepts updates when you file a new return or through specific IRS portals if available. Always use the official IRS website.

If no online update option exists for this payment, consider these alternatives:

- File an accurate tax return with current bank details.

- Contact the Social Security Administration if your benefits record should be used for direct deposit.

- Watch for IRS guidance on non-filer tools or direct deposit update portals tied to this payment.

Direct deposit is often available faster than mailed checks. Banks usually post federal direct deposits within 1 to 3 business days after the Treasury issues them.

How the IRS will notify you

The IRS usually does not send unsolicited emails or text messages asking for bank details. Expect a notice in your IRS Online Account, mailed letters, or official posts on IRS.gov.

Signs of legitimate IRS communication include secure accounts, official IRS.gov links, and mailed notices with a tax form or letter number.

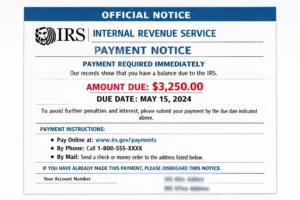

Red flags and how to avoid scams

- Do not share bank account numbers in response to an email or social message claiming to be the IRS.

- Ignore calls that demand immediate payment or ask for a prepaid debit card to receive a benefit.

- Verify any request by logging into your official IRS Online Account on IRS.gov.

Real-world example

Example: Jane, a small business owner, filed her 2023 tax return and confirmed her direct deposit details in January. On February 19, she saw a $2,000 deposit from the IRS in her checking account and received a mailed notice two weeks later confirming the payment.

What Jane did right:

- Confirmed bank info on her most recent tax return.

- Monitored her bank account starting Feb 18.

- Saved the IRS notice for tax records.

If you don’t receive a payment by March

If you believe you were eligible but did not receive the payment within a reasonable window, take the following steps.

- Check IRS.gov for updated timelines or delay notices.

- Review your IRS Online Account for any messages or reason for delay.

- If needed, prepare to claim a credit on your next federal tax return if the payment is a tax credit or reconciliation amount.

Summary: What to do now

In short, verify eligibility, confirm and update bank details using official channels, monitor your bank starting February 18, and save any IRS notices you receive. Acting early reduces the chance of delays.

Always use IRS.gov for the latest official updates and tools related to this payment. If in doubt, consult a tax professional for personalized advice.