This guide explains SNAP Rules January 2026 in clear, practical language. It summarizes common changes states and the federal Food and Nutrition Service (FNS) are using, and gives steps households can take to check eligibility and apply.

Overview of SNAP Rules January 2026

Federal SNAP policy can change each year through rulemaking, state options, and cost-of-living adjustments. The SNAP Rules January 2026 updates focus on eligibility clarity, simplified reporting, and updated thresholds tied to inflation.

States may adopt federal options differently, so your state agency has the final details. Use this article to understand the main categories of change and what to prepare when applying or recertifying.

Key changes under SNAP Rules January 2026

1. Income and resource adjustments

Many income limits are adjusted annually. For January 2026, expect updated gross and net income limits that reflect cost-of-living changes. Some states continue to remove or raise asset tests for certain households.

- Income thresholds: generally adjusted upward from 2025 figures.

- Resource tests: check your state if assets like vehicles or savings are counted.

- Household size matters: limits change by family size and local deductions.

2. Work and training rules

Work requirements for Able-Bodied Adults Without Dependents (ABAWDs) remain a prominent element. Under the January 2026 rules, more focus is on community work and approved training as work participation options.

Exemptions continue for pregnant people, many caretakers, and people with documented disabilities. Look for expanded state waivers in areas with high unemployment.

3. Simplified reporting and application changes

SNAP Rules January 2026 emphasize simplified reporting options for low-income households. Many states are expanding 12-month recertification, streamlined interviews, and online document uploads.

- Online applications: expect continued expansion and mobile-friendly portals.

- Monthly reporting: some states keep simplified reporting for households under certain income levels.

- Expedited service: emergency or very low-income applicants still qualify for fast decisions.

4. Student and immigration updates

Student eligibility rules can change depending on federal guidance and state implementation. More students working with paid internships, apprenticeships, or on-campus jobs may qualify under expanded work-based exemptions.

For noncitizens, January 2026 rules highlight clearer pathways for certain qualified immigrants, especially those with long-term authorized status or those meeting specific program linkages.

Who is eligible under SNAP Rules January 2026?

Eligibility remains based on categorical, income, resource, and work status. Basic categories include families, individuals, seniors, people with disabilities, students who meet exceptions, and some immigrants.

Key factors decision-makers look at:

- Gross and net household income after allowable deductions.

- Household composition and dependent relationships.

- Work status or applicable exemptions (age, disability, caregiving).

- Immigration status if not a U.S. citizen.

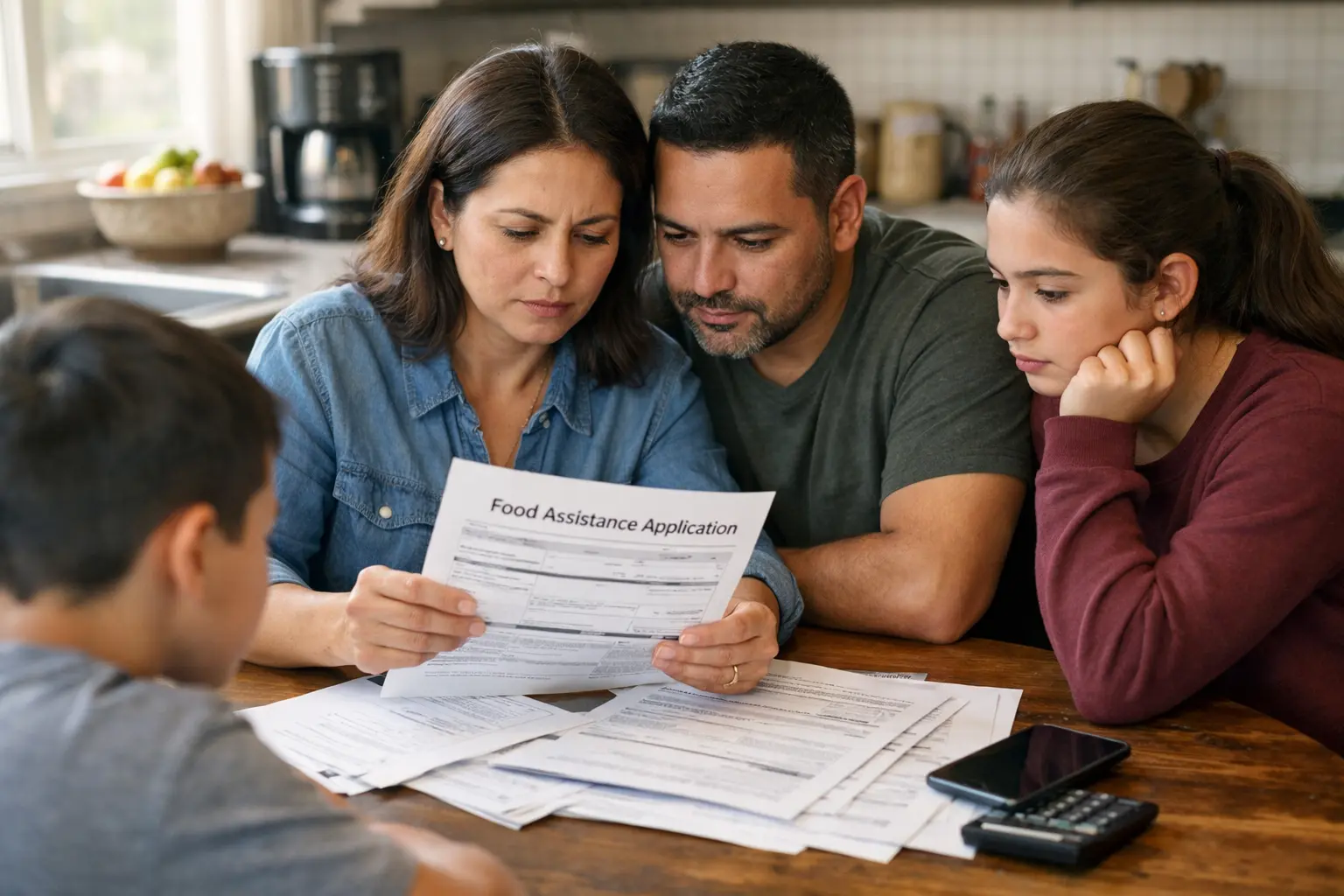

Documents and information to prepare

Before applying, gather common documents so your application proceeds quickly. States often allow digital uploads to speed verification.

- Photo ID and Social Security numbers for household members.

- Proof of income: pay stubs, award letters, unemployment benefits.

- Proof of expenses for deductions: rent/mortgage, utility bills, child care receipts.

- Proof of residency: lease or mail with current address.

Many states allow 12-month certification periods and fewer interim checks for households under certain incomes. This means less paperwork and fewer office visits for qualifying families.

How to apply or check status under SNAP Rules January 2026

Apply through your state SNAP agency website, by phone, or in person at local offices. Most states maintain online account systems to track application status and upload documents.

Steps to apply:

- Find your state SNAP office online and create an account if available.

- Complete the application and upload or present required documents.

- Attend any scheduled interview or provide requested follow-up documents.

- Receive a decision and, if approved, learn how EBT benefits are issued.

Case study: How SNAP Rules January 2026 affect a single parent

Maria, a single parent of two, works part time and pays high rent. Under SNAP Rules January 2026, her state adjusted income thresholds upward for inflation. Maria qualifies for simplified reporting and a 12-month certification period, reducing office visits.

Her monthly benefits were estimated after standard deductions for rent and child care. Because she participates in a job training program recognized by the state, she met ABAWD work-exemption criteria and avoided benefit time limits.

This example shows how combined policy changes—income adjustments, reporting simplifications, and training program recognition—can increase access and reduce administrative burden.

Practical tips and next steps

- Check your state agency web page for exact SNAP Rules January 2026 implementation details.

- Use online application portals and upload documents to speed processing.

- If denied, request a fair hearing and get community legal or benefits counseling.

- Track recertification dates so benefits do not lapse unexpectedly.

SNAP Rules January 2026 aim to improve access while maintaining program integrity. Because states adopt federal options differently, always verify the final rules with your state SNAP office or FNS guidance before making decisions.