Several people are preparing for a large federal deposit expected in February 2026. This article explains who is typically eligible for one-time or periodic federal payments, how dates are usually scheduled, and practical steps you can take now to confirm and receive funds securely.

Big 2000 Federal Deposits Scheduled for February 2026 — Who Might Be Eligible

Federal deposits of a fixed amount often target groups such as Social Security beneficiaries, veterans, low-income households, or recipients of specific tax credits. Eligibility depends on the program authorizing the payment.

Common eligibility categories include:

- Social Security Retirement and SSDI beneficiaries based on benefit records.

- Supplemental Security Income (SSI) recipients if the program is extended to include a payment.

- Veterans with VA benefit accounts if the deposit is a benefit or special payment.

- Tax filers who qualify for refundable credits or rebates through the IRS.

- Low-income households identified through existing benefit rolls or recent filings.

How to check if you are eligible

Eligibility is confirmed only by the issuing federal agency. Use these steps to verify:

- Log in to your account on the relevant agency website (SSA, VA, IRS, or state benefits portal).

- Look for official notices, announcements, or benefit statements indicating a special payment.

- Call the agency’s published phone number if you cannot confirm online.

Dates Confirmed — What to Expect in February 2026

Federal agencies generally post payment calendars ahead of time. Typical deposit timing patterns include mid-month or end-of-month waves based on benefit schedules and recipient groups.

If a large deposit is scheduled, expect one of these common timing methods:

- Rolling deposits across specific days of the month tied to birthdates or last digit of Social Security number.

- Single-day bulk direct-deposit posting for a defined recipient list.

- Checks mailed over several days for beneficiaries without direct deposit.

Key action: check the official agency calendar for February 2026. Do not rely on emails or social media posts that are not linked to an official government site.

Practical timeline examples

Here are common patterns agencies use for large payments:

- SSA/SSI: Payments often follow monthly schedules tied to birth date; special payments may follow similar staged posting.

- VA: Benefit days are usually fixed by calendar; special deposits may post on a single day or a short schedule.

- IRS: Refunds and rebates go out by batch based on return processing order and direct deposit instructions.

Key Actions to Confirm and Receive Your Payment

Follow this checklist to reduce delays and avoid scams.

- Verify bank account info with the issuing agency. Incorrect routing or account numbers are the top cause of misdirected payments.

- Confirm your mailing address if you rely on paper checks. Update it with the federal agency at least two weeks before the payment date.

- Enable direct deposit if possible. Electronic transfers are faster and safer than mailed checks.

- Watch official agency sites for payment notices. Bookmark the SSA, VA, or IRS pages you need.

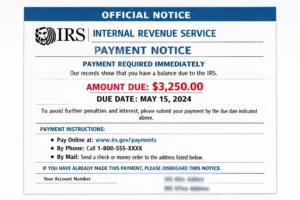

- Beware of scams: no agency will call demanding payment to release your deposit or ask for your bank password.

Documents and information to have ready

- Recent benefit statements or award letters.

- Valid ID and Social Security number (used only on secure agency sites).

- Bank routing and account numbers if you need to update direct deposit details.

- Proof of address if correcting mail delivery before the scheduled date.

Many federal agencies allow beneficiary contact through secure online accounts or official phone lines. Signing up for account alerts can notify you on the day a deposit is posted.

Example Case Study

Case study (illustrative): Maria, a retiree on Social Security, expected a special federal deposit in February 2026. She logged into her SSA account two weeks before the month, verified her bank account was current, and enrolled in email alerts.

When the notice posted on the SSA website, Maria received an alert and confirmed the deposit posted to her bank two days later. Because she had direct deposit and an updated account, she avoided any mailing delay.

What to Do If You Don’t Receive a Scheduled Deposit

If the date passes and you have not received the funds, take these steps right away:

- Check your benefit account and any official messages for updates or delays.

- Contact your bank to see if the deposit is pending or returned.

- Call the issuing agency using the phone number on its official website — not a number in an unsolicited email or text.

- If you believe the funds were misdirected, file a claim with the agency and keep records of all communications.

Final reminders

Confirm eligibility only through official federal agency channels. Scammers will use news about large federal deposits to impersonate agencies and request personal information. Keep passwords and banking details private.

Following the steps above will help you confirm whether you are eligible for the February 2026 payment, find the confirmed dates for your group, and take the practical actions needed to receive funds safely.