This guide explains eligibility and provides clear claim instructions for the Federal 2000 Relief Deposits scheduled for February 2026. Read the steps, required documents, and timelines so you can act quickly and accurately.

Who Is Eligible for Federal 2000 Relief Deposits February 2026?

Eligibility is based on income, filing status, and certain life circumstances. The program targets households affected by recent economic changes and qualifying low-to-moderate income taxpayers.

Common eligibility rules include:

- Individual adjusted gross income (AGI) below a specified threshold for 2024 or 2025 tax returns.

- Dependents and head-of-household rules that increase qualifying amounts for larger families.

- Special allowances for veterans, seniors, and those on disability in certain states.

Exceptions and Special Cases

Certain nonresident aliens, recent immigrants, and taxpayers with unresolved tax issues may be excluded. Check the official federal notice for precise exclusions before applying.

How Much Will the Federal 2000 Relief Deposits February 2026 Pay?

The base payment amount is 2000 USD per qualifying household, with phased reductions for higher incomes within the eligibility window. Additional amounts may be available for dependent children or qualifying caregivers.

Payments will be deposited electronically where tax or benefit agencies have current direct deposit information. Paper checks are issued only when direct deposit is not on file.

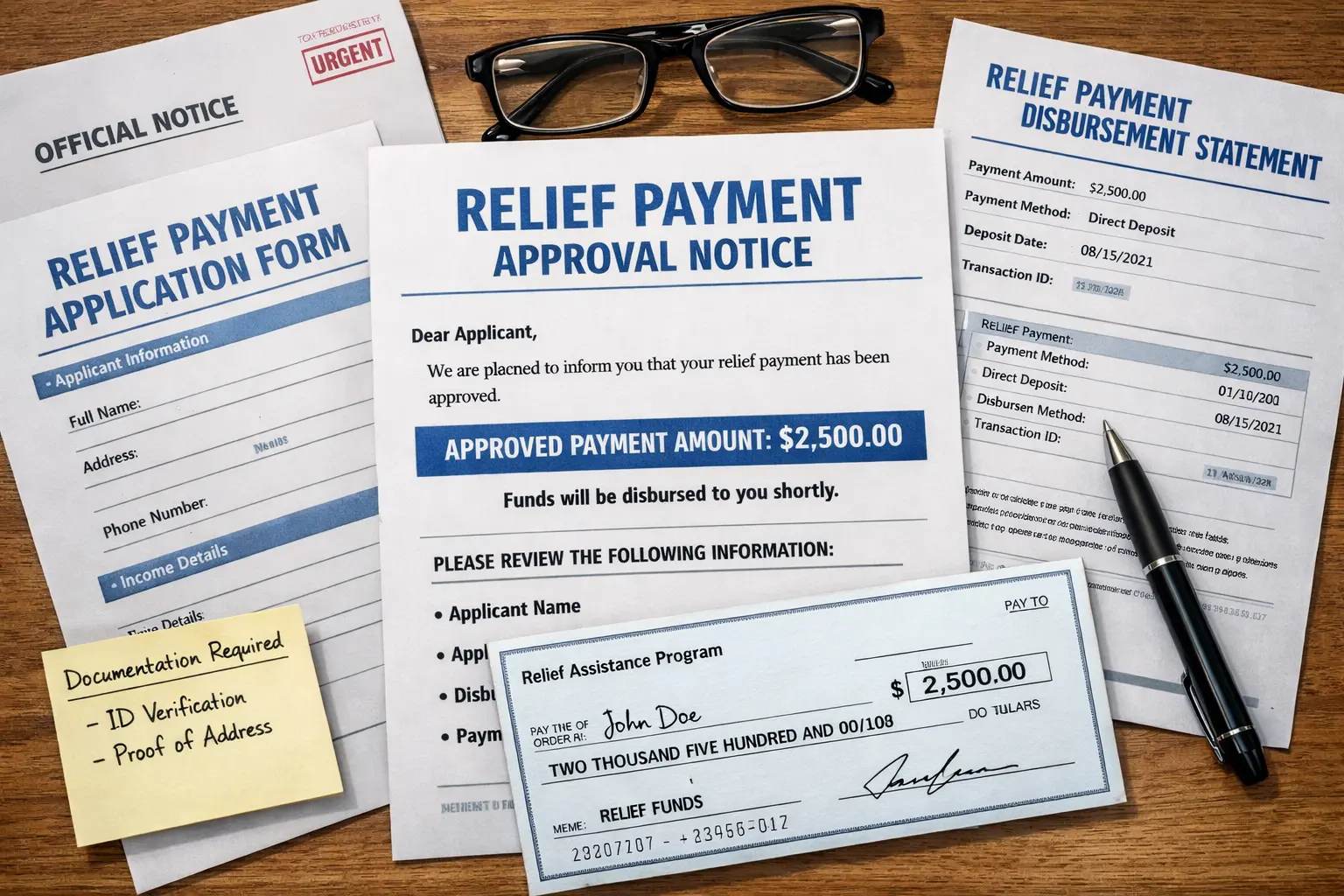

What Documents You Need to Claim Federal 2000 Relief Deposits February 2026

Gather these documents before you start a claim. Having them ready speeds up verification and reduces processing delays.

- Most recent federal tax return (2024 or 2025) showing AGI and filing status.

- Government-issued ID: driver license, state ID, or passport.

- Proof of address: utility bill, lease, or bank statement.

- Direct deposit information: routing and account numbers (if you want electronic payment).

- Proof of benefits if you receive Social Security, SSI, or similar programs.

Step-by-Step Claim Instructions for Federal 2000 Relief Deposits February 2026

Follow these steps to submit a valid claim. Choose the method that matches your comfort with online forms or paper filings.

1. Verify Eligibility

Use the official eligibility checker on the federal relief portal or consult the published criteria. Save a screenshot or PDF of the eligibility confirmation for your records.

2. Prepare Documents

Scan or photograph all required documents in clear, legible format. Files should be under the portal’s size limits and labeled logically.

3. Submit Online (Preferred)

- Create or log into your secure account on the federal relief portal.

- Complete the online claim form with personal details and bank account information if you want direct deposit.

- Upload documentation and confirm all entries are accurate.

- Review the confirmation screen and save the claim ID and confirmation email.

4. Submit by Phone or Mail

If you cannot apply online, phone assistance and paper claim forms are available. Expect longer processing times for mailed claims.

- Phone: Call the official relief hotline listed on the federal site during business hours.

- Mail: Send the completed paper form with copies of documents to the address on the form. Use tracked mail for proof of delivery.

Processing Time and Payment Timeline

After a complete claim is submitted, standard processing takes 3 to 6 weeks. Incomplete claims may take longer while documentation is requested and verified.

Direct deposit payments are issued first. Paper checks follow in batches when direct deposit is not available.

Some states automatically enroll citizens who received recent pandemic-era credits, so you may receive the Federal 2000 Relief Deposit without filing a new claim. Check your account or mail for an official notice.

Common Problems and How to Avoid Them

Most delays come from mismatched names, missing signatures, or outdated bank details. Double-check all fields before submitting.

- Use the exact name shown on your tax return and ID documents.

- Confirm routing and account numbers by reviewing a recent bank statement.

- Respond promptly to any verification requests from the relief agency.

Small Real-World Example: Case Study

Maria, a single parent in Ohio, discovered she qualified after checking the federal portal. She uploaded her 2024 tax return and bank info, then received a claim ID by email.

Her direct deposit arrived three weeks later. When the agency requested proof of childcare for an extra dependent allowance, she uploaded a receipt the next day and the agency adjusted the payment within 10 days.

What to Do If Your Claim Is Denied

If a claim is denied, the portal will list the reason. Common causes include income over the threshold or incomplete documentation.

Appeal steps include submitting additional documents, correcting errors, or requesting a review. Follow the appeals timeline exactly to preserve your rights.

Where to Find Official Information and Updates

Only rely on the official federal relief website, the agency hotline, or notices mailed to you. Fraudulent offers and phishing emails are common around relief disbursements.

- Bookmark the federal relief portal and check updates weekly.

- Only use official phone numbers listed on government pages.

- Never provide your full Social Security number in email replies; use secure portals instead.

Follow the steps above to prepare and submit your claim for the Federal 2000 Relief Deposits February 2026. Careful preparation and timely responses to documentation requests will help ensure a smooth payment process.