Federal $2000 Stimulus Payments in February 2026: Who Qualifies

This guide explains who is eligible for the federal $2000 stimulus payments scheduled in February 2026, the expected timeline, and how to claim a payment if you do not receive it automatically. Read each section for practical steps you can follow.

Who qualifies for the $2000 payment

Eligibility centers on citizenship, income, and tax filing status. Most U.S. citizens and qualifying resident aliens who filed 2024 or 2025 tax returns will be evaluated automatically for payment.

Basic eligibility points:

- Must be a U.S. citizen or qualifying resident alien.

- Must not be claimed as a dependent on another taxpayer’s return.

- Adjusted Gross Income (AGI) must be under specific thresholds (see next section).

Income limits and phaseouts

Payments phase out by filing status. The exact thresholds are set by the 2026 legislation and published by the Treasury and IRS. Generally expect:

- Single filers: full payment at lower AGI limits, reduced at higher AGI.

- Married filing jointly: higher combined AGI limits before reductions begin.

- Heads of household: thresholds between single and joint limits.

Check the IRS website for the official 2026 AGI brackets. If your AGI is just above a threshold, you may receive a partial payment or be eligible to claim the remainder when you file taxes.

February 2026 timeline and distribution process

The government typically follows a phased distribution. February 2026 is the primary month for the initial direct deposit and mailed checks.

What to expect:

- Direct deposits issued first to those with IRS direct deposit info on file.

- Paper checks and prepaid debit cards mailed in subsequent weeks.

- IRS online tools updated to show payment status within days of issuance.

How payments are matched

The IRS matches eligibility using your most recent tax return or information from Social Security Administration records. If your address or bank information changed and you did not update the IRS, delivery may be delayed.

How to check if you will get the Federal $2000 Stimulus Payments in February 2026

Use official channels to check your status and avoid scams. The IRS will provide a portal or update its existing payment tool for 2026 payments.

Steps to check your status:

- Visit the IRS website and use the designated payment status tool.

- Have your Social Security number or ITIN ready, plus your filing status.

- Verify the payment method shown (direct deposit, check, or card).

Common reasons a payment is delayed

- Unfiled or missing 2024 tax return information.

- Recently changed bank or mailing address not updated with the IRS.

- Identity verification issues flagged by the IRS.

People who receive Social Security benefits and do not file tax returns may still get an automatic payment if the SSA provided eligibility data to the IRS.

How to claim a missed payment or correct an error

If you did not receive an expected payment, you can claim it when you file your 2026 federal tax return. The IRS will provide a specific recovery or credit form similar to past stimulus credit claims.

Immediate steps if a payment is missing:

- Confirm your payment status on the IRS site first.

- If missing, file your 2026 tax return and include the claim for the stimulus credit or follow IRS instructions for a recovery payment.

- Keep documentation: tax returns, bank statements, and any IRS notices.

How to update IRS records

To avoid delays, update your address and direct deposit info. Options include:

- Use IRS online account tools to update bank details if allowed.

- File Form 8822 to change your address if online update is not possible.

- Contact the IRS only through official numbers listed on IRS.gov to avoid scams.

Real-world example

Case study: Maria is a single parent who filed her 2025 taxes and listed a bank account for refunds. When the February rollout occurred she received a direct deposit notification. Maria verified her IRS account, confirmed the payment, and used it to cover urgent rent and utility bills. She saved the IRS notice as proof in case of discrepancies.

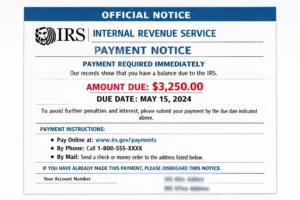

Protect yourself from scams

Scammers often target people during stimulus distributions. Remember these rules:

- The IRS will not call and threaten immediate arrest for unpaid taxes tied to stimulus payments.

- The IRS will not demand payment via gift card, crypto, or prepaid debit card.

- Only use IRS.gov for official information and tools.

Final checklist before February 2026

- File your 2024 or 2025 tax return if required.

- Ensure your address and direct deposit info are current with the IRS.

- Monitor the IRS payment tool and save any notices.

- Prepare to claim a missed payment on your 2026 tax return if necessary.

If you have unusual circumstances, such as an identity theft issue or being a non-filer with qualifying income, consult the IRS guidance or a trusted tax professional for help. Follow official IRS updates as they release complete rules for the $2000 payment and eligibility details in 2026.