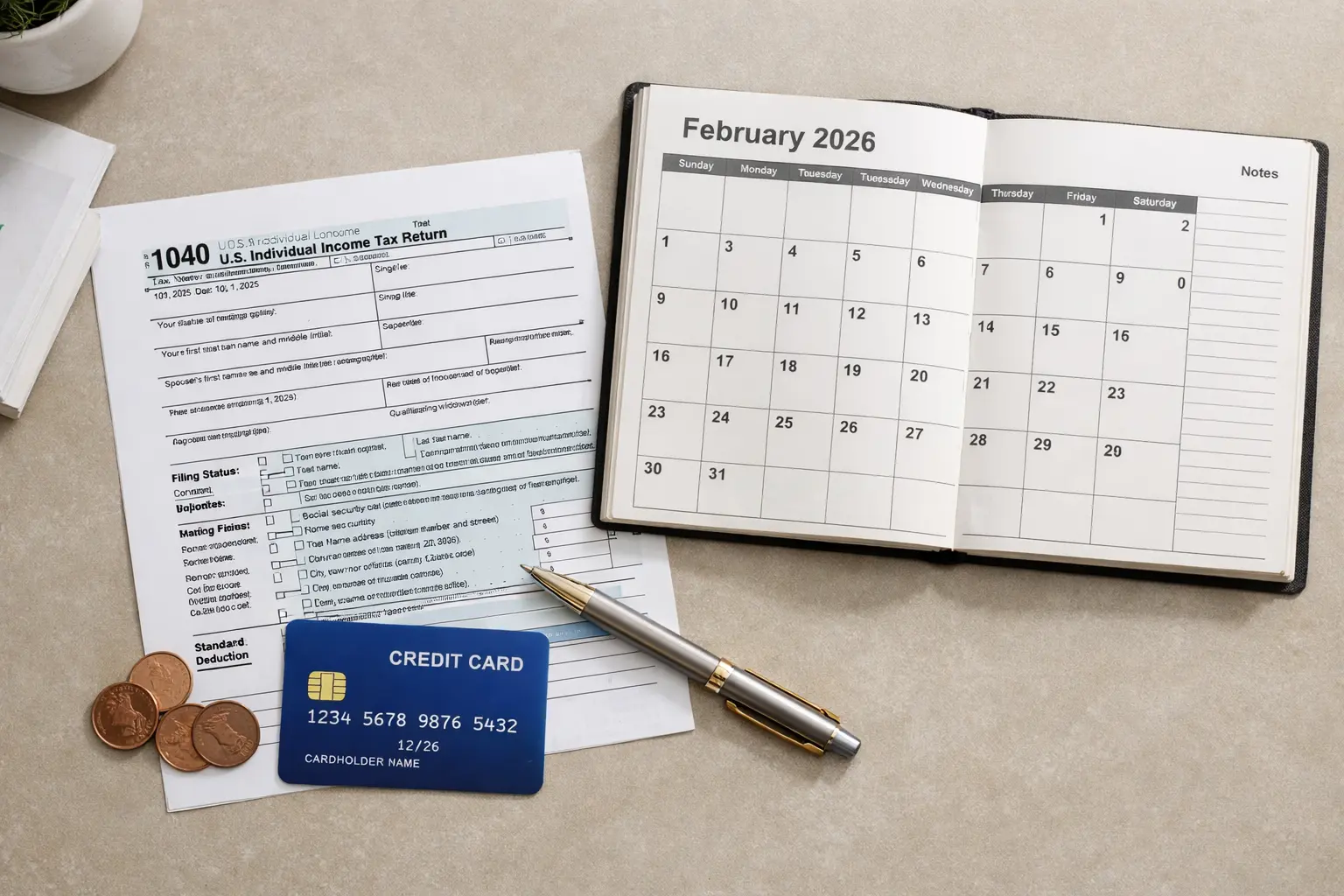

The IRS announced a $2,000 direct deposit distribution scheduled for February 2026. This guide explains how the payment is delivered, who should expect it, how to check the status, and steps to take if the money does not arrive.

What the IRS $2,000 Direct Deposit means for February 2026

The IRS direct deposit is an electronic transfer of funds into a bank account. For February 2026, eligible taxpayers are expected to receive a one-time $2,000 payment by direct deposit or by mailed check, depending on the IRS records for each filer.

This is a practical overview, focusing on process and actions you can take. If you need confirmation about your individual status, use IRS official tools and contact lines.

IRS $2,000 Direct Deposit eligibility and who gets paid

Eligibility depends on tax filing status, income limits, and IRS records. Common factors that affect eligibility include recent tax returns, Social Security benefit status, and whether the IRS has valid banking information on file.

- Filed 2024 or 2025 tax return with the IRS

- Bank account information on file with the IRS or previously used for refunds

- Meets income and filing criteria defined by the legislation authorizing the payment

If you did not file a return but receive Social Security or other federal benefits, the IRS may use benefit records to issue payment. Always confirm eligibility with the IRS website or your tax professional.

How the IRS $2,000 Direct Deposit arrives in your bank

When the IRS sends a direct deposit, it originates as an ACH transfer to the bank account the IRS has on file. The deposit description may show as a generic government credit, not necessarily labelled “$2,000 payment.”

- Timing: ACH transfers usually post in one business day once released, but processing schedules vary by bank.

- Bank holds: Some banks may show a pending credit before funds are fully available.

- Notification: The IRS often mails an informational notice after issuing payments; check mail and email for alerts.

Checking your IRS $2,000 Direct Deposit status

Use IRS online tools and official notices to verify status. The IRS typically provides a status checker for major distributions and may announce batch release dates.

Tools to check IRS $2,000 Direct Deposit

- IRS payment status tool: Check if your payment was scheduled, issued, or pending.

- Account transcript or online account: Verify your return and refund history.

- Bank statements: Watch for an ACH credit around announced dates.

If you cannot find status online, call the IRS support number listed on IRS.gov or consult a tax professional. Avoid third-party sites that demand personal information or fees to check status.

What to do if you do not receive the IRS $2,000 Direct Deposit

If you expected a $2,000 direct deposit and it did not arrive, follow a clear set of steps to locate or replace the payment. Work through these in order to avoid unnecessary delays.

- Confirm eligibility and that the IRS scheduled payment for your tax ID.

- Verify the bank account the IRS has on file is correct and active.

- Check with your bank for pending ACH credits and any holds.

- Review mail for an IRS notice about a mailed check or adjustment.

- Contact the IRS if the payment shows as issued but you did not receive it.

If the IRS issued a direct deposit to an old or closed account, the bank may return the funds to the IRS and the agency will reissue via mail. That process can take several weeks.

Common problems and quick fixes

- Wrong bank account: Update your direct deposit info with the IRS on future filings and consider filing a trace with the IRS for the missing payment.

- Identity theft hold: If the IRS flagged your account, follow IRS instructions to clear identity verification.

- Scams: The IRS will not call asking for bank account numbers or payment to get your $2,000. Ignore texts or calls requesting personal data.

Tax and reporting considerations for the IRS $2,000 Direct Deposit

Most one-time government payments are not taxable income, but you should confirm how this payment is treated for federal taxes. The IRS will include guidance on reporting if necessary.

Keep the informational notice the IRS sends after payment. It may be useful for recordkeeping or for questions on future tax returns.

Real-world example

Maria filed her 2025 tax return electronically and listed direct deposit for her tax refund. She checked the IRS payment status two days after the announced release and saw the payment marked as “issued.”

Her bank listed a pending ACH credit the next business day and the $2,000 became available within 24 hours. Maria received an IRS notice in the mail two weeks later confirming the direct deposit amount and date.

Key actions Maria took that helped: she verified her bank account on her tax return, monitored the IRS status tool, and checked her bank statements the morning after issuance.

Practical tips to prepare for the IRS $2,000 Direct Deposit

- Verify your bank routing and account numbers on your latest tax return.

- Sign up for an online IRS account and set up alerts if available.

- Keep paper copies of recent returns and notices for quick reference.

- Be cautious of scammers offering to speed up payment for a fee—these are fraudulent.

Following these steps will reduce confusion and speed up resolution if you do not see the deposit when expected. When in doubt, rely on IRS.gov and official notices as your definitive source of information.