IRS 2000 Direct Deposits: What to Expect in February 2026

The IRS plans to issue 2000 direct deposit payments beginning in February 2026 to eligible taxpayers and certain beneficiaries. This guide explains who is eligible, when payments are likely to arrive, and the rules that affect recipients and their representatives.

Eligibility for IRS 2000 Direct Deposits

Eligibility generally depends on your filing status, Social Security number status, residency, and whether you were claimed as a dependent on someone else’s return. The IRS will use the most recent tax return or non-filer information on file to determine eligibility.

Typical eligibility checkpoints include:

- Valid Social Security number for the taxpayer and qualifying dependents (if required).

- Not claimed as a dependent on another taxpayer’s return.

- Residency and citizenship rules may apply (U.S. residency usually required).

- Income thresholds or phaseouts if authorized by law—check IRS guidance for exact AGI limits.

Special cases: Social Security and SSI recipients

Many Social Security, Railroad Retirement, and SSI recipients who meet eligibility will receive direct deposits automatically using federal benefit payment information. If you receive benefits and expect a payment, verify your bank info with your benefit provider and monitor IRS updates.

Payment Dates: How and When Deposits Arrive

Payments are scheduled to start in February 2026 and will be issued in waves across the month. The exact timing depends on processing queues, filing date, and whether the IRS already has valid direct deposit information on file.

What to expect:

- Early February: initial deposits to taxpayers with verified bank info and straightforward claims.

- Mid to late February: additional deposits as the IRS processes more returns and non-filer submissions.

- If a direct deposit fails, the IRS may mail a check or prepaid debit card instead, which can take longer to arrive.

How to track your payment

Use IRS tools to check payment status and updates. The IRS will publish a tracking tool on IRS.gov if one is available for this program. Typical actions:

- Check the IRS payment status tool for your expected deposit date.

- Review your most recent tax return to confirm the bank routing and account number used.

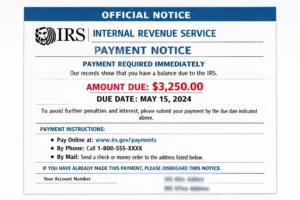

- Watch for mailed notices that explain what was sent and why.

The IRS usually uses the bank account information from your most recent tax return or benefits account to send direct deposits. If that information is outdated, payments can be delayed or issued by paper check.

Rules for Beneficiaries and Representative Payees

Payments generally go to the individual who is eligible. When a beneficiary cannot manage finances directly, a representative payee, guardian, or an appointed fiduciary may receive the funds on their behalf if permitted by law.

Key rules to follow:

- Representative payees must be authorized under applicable program rules to accept payments for another person.

- Payments for deceased individuals: if the recipient died before the payment was issued, rules vary—family members may need to follow IRS procedures for return or reallocation.

- Joint accounts: if the bank account belongs to more than one person, confirm whether the IRS will permit deposit into that account (typically it will if the taxpayer authorized it on their return).

What to do if you are a beneficiary but did not receive payment

First, confirm whether the IRS considers you the eligible recipient. If you believe a representative or estate should have received the payment, follow these steps:

- Check the IRS payment status tool and any mailed notices.

- Contact the IRS or the benefit program office to report a missing payment.

- If necessary, claim the payment as a credit on the 2026 tax return (if the program allows reconciliation through the tax filing process).

How to Update Bank Information or Correct Errors

If the direct deposit will use outdated or incorrect bank information, you have limited options once payments begin. To minimize issues, update information in advance.

- File the latest tax return with accurate direct deposit details before the IRS runs payment batches.

- Use any IRS non-filer or bank update tool that the agency offers for the payment program (check IRS.gov for availability and deadlines).

- If the deposit fails and a check is mailed, deposit or cash the check and then notify the IRS if you believe the payment was incorrect.

Common problems and solutions

If the IRS issues a payment to the wrong account, contact your bank immediately. Banks typically have procedures to return wrongly deposited funds when an institution-level error is confirmed.

For missing or delayed payments, document communications and keep copies of notices. If you must claim a credit on your 2026 tax return, save proof of non-receipt to support your claim.

Real-World Example

Example: Maria is a single filer who updated her 2025 return with direct deposit information in December 2025. She tracked the IRS tool and received her 2000 deposit by direct deposit on February 11, 2026. When her elderly neighbor, who receives Social Security, did not get the payment, Maria helped the neighbor confirm bank information with SSA and contacted the IRS helpline to report the missing deposit. The neighbor later received a mailed check two weeks after the initial processing wave.

Final Checklist Before February 2026

- Confirm your eligibility using IRS guidance and your 2024 or 2025 tax return details.

- Update direct deposit information on your next tax return or via any IRS update tool available now.

- Monitor the IRS payment status tool and watch for mailed notices.

- If acting as a representative, gather documentation proving your authority to receive funds on behalf of someone else.

For official rules, exact deadlines, and the latest payment schedule, always check IRS.gov. The IRS will post the most current guidance, tools, and FAQ pages related to the February 2026 direct deposit program.