What the February 2026 $2,000 direct deposit means for taxpayers

The IRS has confirmed a one-time $2,000 direct deposit scheduled for February 2026 as part of a new tariff rebate plan. This article explains who is eligible, how the payment will be delivered, and practical steps you can take now.

Read this to understand timelines, required actions, and how the tariff rebate interacts with other tax and benefit programs. The focus here is practical and neutral guidance based on public IRS guidance and typical payment processes.

IRS Confirms February 2026 $2,000 Direct Deposit: key facts

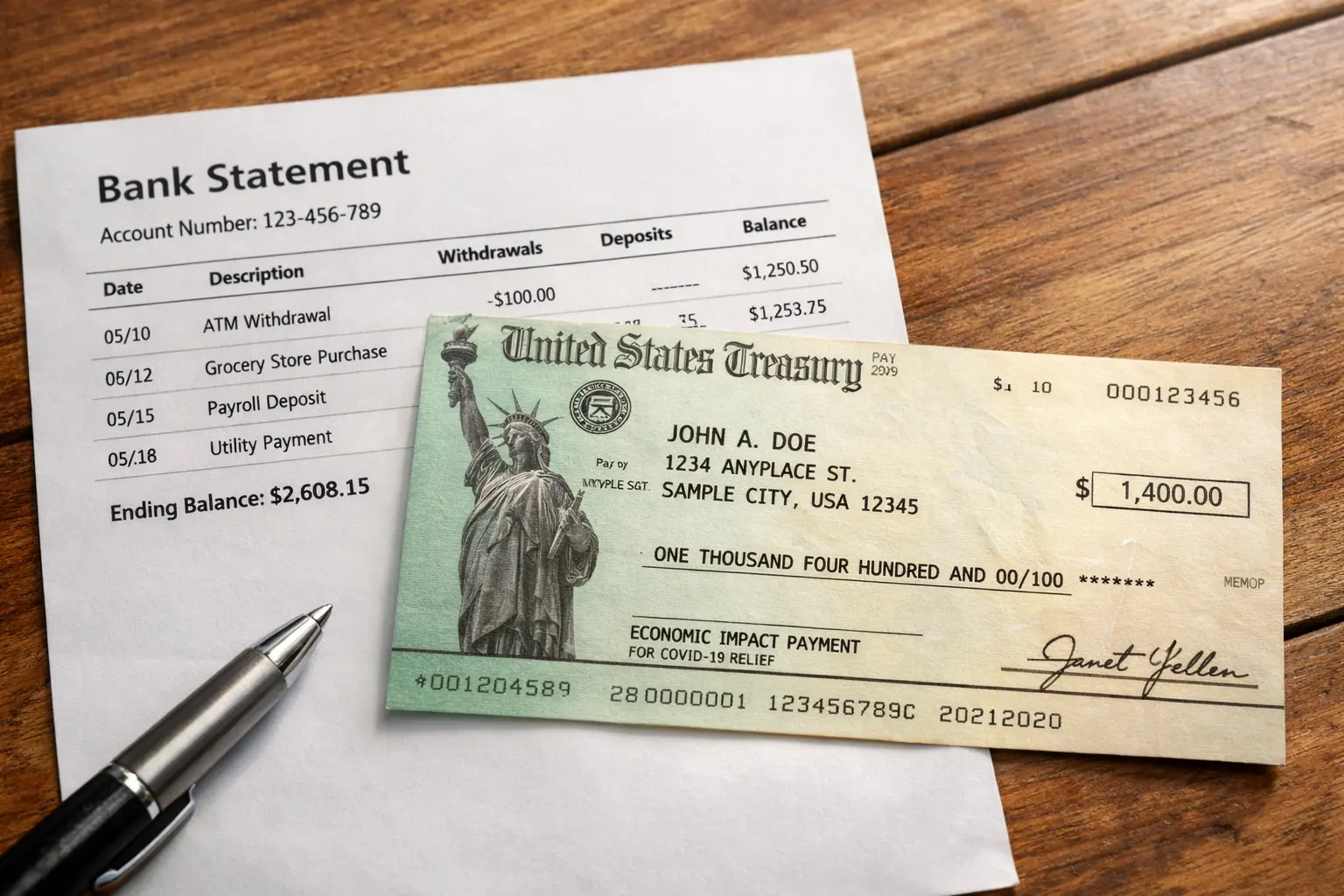

The tariff rebate plan provides a one-time payment designed to return a portion of tariff revenues to qualifying individuals. The IRS will use existing taxpayer records to identify recipients and deliver payments via direct deposit or mailed checks.

Key facts to remember include eligibility rules, timeline for delivery, and the differences between direct deposit and paper check delivery. Knowing these details helps prevent confusion and reduces calls to IRS phone lines.

Who is likely eligible under the tariff rebate plan

Eligibility generally depends on prior tax filings, income limits, and residency requirements. The IRS typically relies on recent tax returns or Social Security records to determine recipients.

Common eligibility elements include:

- Filed a 2024 or 2025 federal tax return or received Social Security benefits in 2025.

- Income below the threshold specified by the rebate legislation or administrative guidance.

- U.S. residency for tax purposes during the qualifying period.

How the direct deposit will be processed

Direct deposit will use bank account information the IRS already has on file from recent returns or prior benefit enrollments. If the IRS lacks valid banking details, they will send a paper check instead.

Important operational notes:

- The IRS will not accept new direct deposit instructions for this payment window; it uses existing records.

- If you changed banks and did not update the IRS or Social Security Administration, your payment may be mailed to the last known address.

- Expect processing notices in your online IRS account or mailed letters if there are issues.

How the new Tariff Rebate Plan really works

The tariff rebate is funded by excess tariff revenue and structured as a one-time rebate rather than a recurring benefit. The IRS acts as the distribution agent under statutory direction.

The core mechanics are straightforward: identify eligible recipients, calculate the rebate amount, and distribute payments through direct deposit or check. Administrative guidance determines rules for dependents, joint filers, and special cases.

Calculation and interactions with other benefits

The rebate amount is fixed per eligible adult and may have reduced amounts for dependents or phase-outs for higher incomes. The rebate is usually not taxable income, but verify IRS guidance for final tax treatment.

Possible interactions include:

- Means-tested programs: the rebate may or may not count toward income limits—check your program rules.

- Tax filing refunds: the rebate is separate from regular tax refunds and will not change your 2025 refund unless specifically stated.

- Offsets: existing federal offsets (like unpaid federal student loans or past-due taxes) could reduce the amount you receive.

Practical steps to prepare for the February 2026 payment

Follow these steps to make sure you receive the money on schedule and avoid avoidable delays. Most items are simple checks you can complete in minutes.

- Verify your address and bank information in your IRS online account or with the Social Security Administration.

- Review recent tax returns to confirm filing status and dependents were correctly reported.

- Watch for official IRS mailings and emails; the IRS will not call and ask for bank details for this payment.

- Sign up or log into your IRS account to track payment status after the IRS posts an announcement window.

What to do if you do not receive the deposit

If you expected the $2,000 direct deposit in February 2026 and do not receive it, first check your IRS online account for status updates. Mail delays or banking changes are common reasons for missing payments.

If there is no update, contact the IRS using published phone numbers or use the online inquiry forms. Keep documentation like your 2024 or 2025 tax return handy when you call.

The IRS often uses information from the most recent tax return or Social Security records to issue one-time rebates — which is why keeping these records current matters.

Small real-world example

Case study: Maria, a nurse in Ohio, filed her 2025 federal return electronically and received her regular refunds by direct deposit. The IRS used her 2025 bank information to send the $2,000 tariff rebate in February 2026.

Because Maria updated her address earlier in 2025, she avoided any mailing delays. She confirmed the deposit in her online bank account and did not need to contact the IRS.

Common questions and final tips

Below are quick answers to common questions about the rebate and practical tips to reduce problems.

- Will the rebate be taxed? Check final IRS guidance; many similar rebates were non-taxable.

- Can I change where the rebate is sent? Not for the February 2026 window; the IRS uses existing records.

- Will the rebate affect benefits? It depends on the rules of the benefit programs you receive.

Final tips: keep your contact and banking information current, watch for official IRS announcements, and avoid third-party services that promise faster delivery for a fee.

Where to find official updates

Check the IRS website and official Treasury announcements for the authoritative schedule, eligibility lists, and instructions. The Treasury and IRS will publish frequently asked questions and timelines as the disbursement date approaches.

Using official sources prevents scams and misinformation. If in doubt, contact the IRS directly through the channels listed on IRS.gov.

This guide provides practical steps and a clear understanding of the February 2026 $2,000 direct deposit under the tariff rebate plan. Follow the steps above to prepare and protect your payment.