The USA minimum wage increase 2026 affects workers and employers in multiple states and localities with scheduled changes that take effect on February 1. This article explains how to find the new hourly pay rates, update payroll, and keep your business compliant.

USA Minimum Wage Increase 2026: Overview

There is no single federal increase that covers all workers for 2026. Instead, many states, counties, and cities implement scheduled minimum wage increases on specific dates, including February 1, 2026.

Each jurisdiction sets its own rate and rules. Employers must check state and local labor department announcements to confirm exact hourly pay rates and effective dates.

Who Is Affected by the New Hourly Pay Rates

Most hourly employees working for covered employers in jurisdictions with an increase will be affected. This includes full-time, part-time, and temporary staff when the local law applies.

Exemptions vary. Common exceptions include tipped employees, certain youth or training wages, small employer thresholds, and specific industry exemptions. Verify local law for details.

Check These Sources for Official Rates

- State labor department websites

- City or county official websites

- Industry trade associations and payroll providers

- Official notices or posters employers must display

How New Hourly Pay Rates Affect Payroll

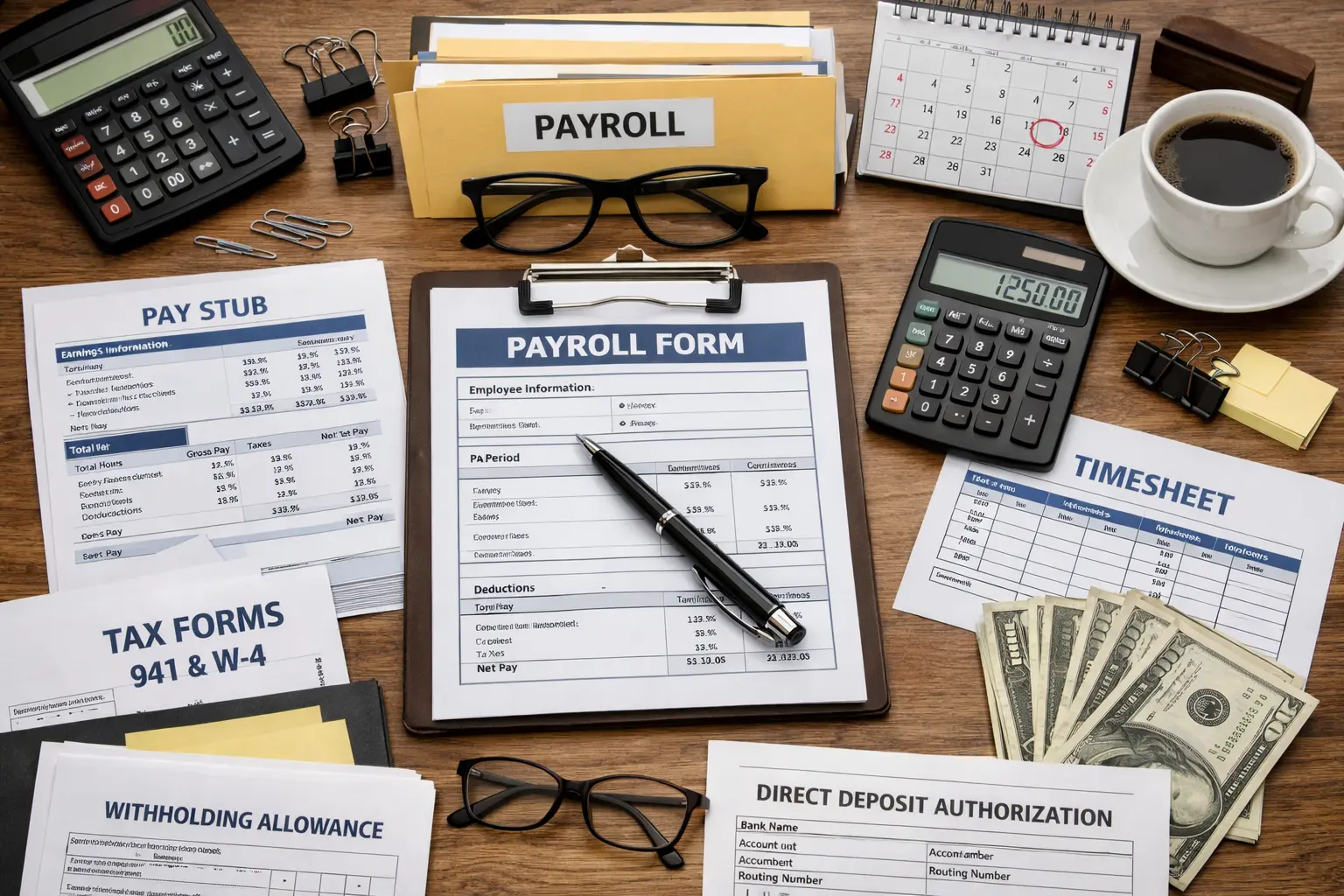

When a minimum wage increase takes effect, employers must update pay rates, payroll calculations, and withholding. This often requires changes to payroll software, timesheets, and pay statements.

Key payroll actions include updating the employee pay rate, recalculating overtime thresholds where applicable, and adjusting employer tax and benefit contributions tied to wages.

Step-by-Step Payroll Update Checklist

- Confirm the new hourly rate for your location and worker classifications.

- Update payroll software pay rules and employee profiles before the effective date.

- Recalculate overtime and premium pay if the base rate changes eligibility.

- Prepare payroll runs and verify deductions and tax calculations.

- Notify employees in writing about the new hourly pay rate and effective date.

Calculating the Cost Impact

Estimate the business impact by calculating the difference between the old rate and the new rate for each affected employee, and then multiply by hours expected to be worked.

Use a simple formula to estimate monthly cost increase: (New Rate − Old Rate) × Hours per Week × 4.33.

- Example quick estimate: If a worker moves from $12.00 to $13.50 and works 30 hours per week, monthly increase ≈ ($1.50 × 30 × 4.33) = $194.85.

Compliance Tips for Employers

Staying compliant reduces legal risk and payroll errors. Follow these practical steps ahead of February 1.

- Post updated minimum wage notices where required.

- Retain documentation of rate changes and internal communications.

- Train payroll and HR staff on the new rules and exemptions.

- Review contracts and collective bargaining agreements for required notice or renegotiation clauses.

Local minimum wage changes can apply to different types of employers differently. Some cities have a higher rate for large employers and a lower one for small employers.

Tipped Workers and Special Rules

Many jurisdictions have separate rules for tipped employees, allowing a lower direct-cash wage if tips make up the difference to the standard minimum wage. The allowed tip credit and documentation requirements vary by location.

If you employ tipped staff, confirm whether the tip credit or a full minimum cash wage applies after February 1 and update payroll practices accordingly.

Real-World Example: Small Café Case Study

Bluebird Café is a four-employee coffee shop in a city that implemented a minimum wage increase effective February 1, 2026. Management followed a simple process to adapt.

- Step 1: They checked the city labor website two months before the change to confirm the new rates and tip credit rules.

- Step 2: The owner updated the POS and payroll system to the new rates one week before the effective date and ran parallel pay calculations to confirm accuracy.

- Step 3: They informed employees in writing and adjusted weekly schedules slightly to manage labor cost while keeping hours steady.

Outcome: Bluebird Café avoided payroll errors, maintained staff morale, and documented compliance with local law.

Employee Communication Best Practices

Clear, timely communication helps reduce confusion. Provide employees with a written notice that states the new hourly pay rate, the effective date, and any changes to tip policies or benefits calculations.

Offer short Q&A sessions and distribute a simple payroll FAQ to answer common concerns about take-home pay and overtime.

Where to Get Help

If you are unsure about local rules or complex situations like exemptions and retroactive pay, consider these resources:

- State or city labor department helplines

- Certified payroll providers or accountants

- Employment law attorneys for complex disputes

Preparing early for the USA minimum wage increase 2026 and the new hourly pay rates taking effect on February 1 will minimize disruption and help ensure accurate pay for employees. Confirm local rates, update payroll systems, and communicate clearly to stay compliant.