2000 Direct Deposit IRS Alert for February 2026: What happened

In February 2026 the IRS opened payment windows for a one-time 2000 direct deposit program for qualifying taxpayers. The agency issued clarifications about timing, eligibility, and how banks post funds.

This article explains the payment windows, the clarified rules, and practical next steps for individuals who expect the 2000 deposit but have not yet received it.

How the payment windows opened and what to expect

The IRS released a schedule of deposit windows to manage a large number of payments. Deposits are sent in batches over several days, not all at once.

Typical expectations:

- Payments are sent by electronic transfer to bank accounts on file with the IRS.

- Banks may take 24 to 72 hours to post a deposit once the transfer is initiated.

- Some recipients will see the deposit earlier or later depending on batch timing and bank processing.

2000 Direct Deposit IRS Alert for February 2026: Key rules clarified

The IRS clarified several rules to reduce confusion. These clarifications affect eligibility, bank routing, and correction procedures.

- Eligibility is based on filing status, income limits, and the tax year used to determine benefit amounts.

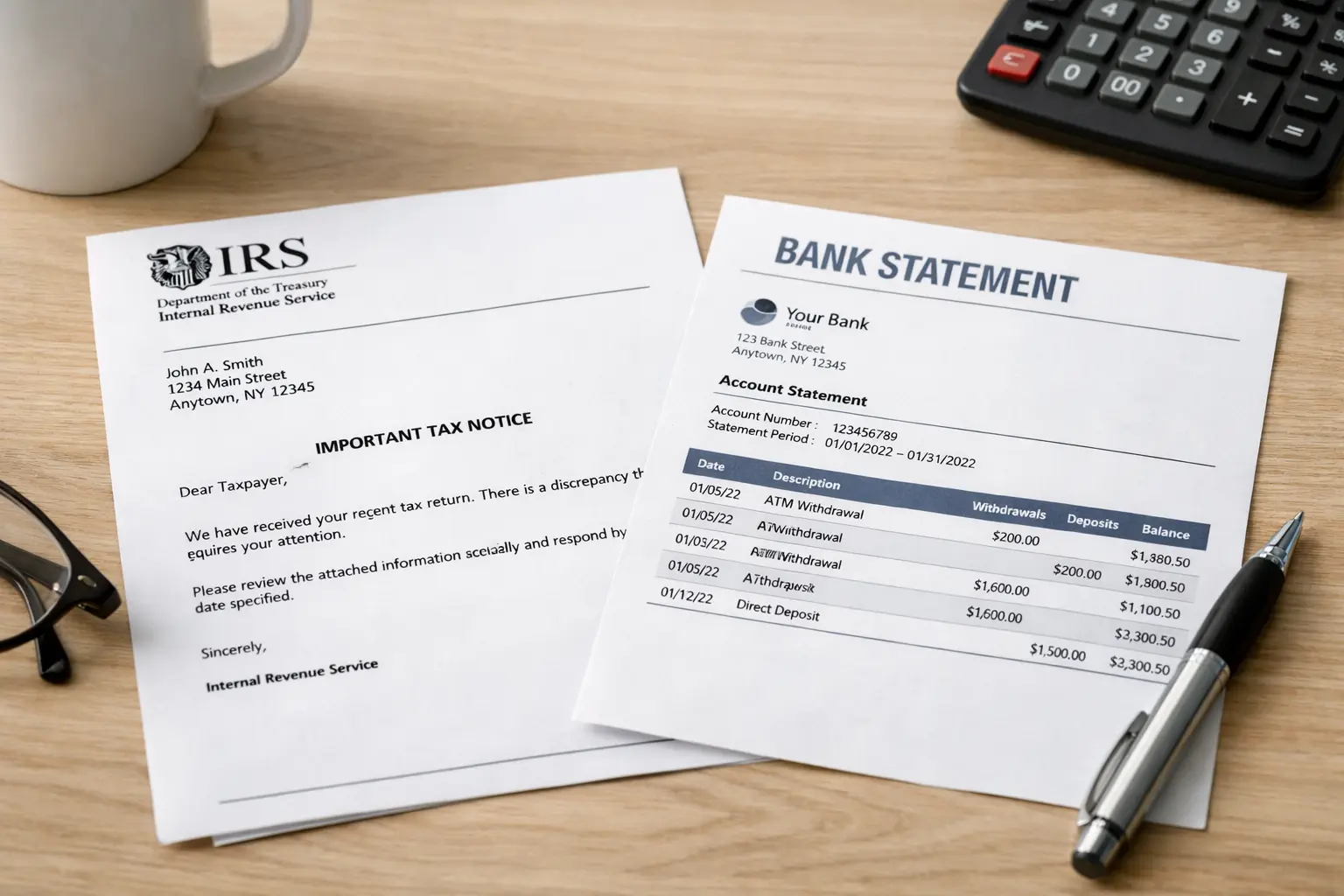

- Direct deposit will use the bank account and routing numbers the IRS has on file from recent tax returns or direct-payment registration.

- If a direct deposit fails because of a closed or incorrect account, the IRS will generally try to issue a paper check or provide instructions to claim the payment when you file your next return.

Who qualifies and who should expect the 2000 direct deposit

Qualification depends on program rules announced by the IRS for February 2026. Typical criteria include:

- Meeting income thresholds or other eligibility rules declared by law.

- Having a valid Social Security number or taxpayer identification number.

- Not being claimed as a dependent by another filer, if that is part of the eligibility definition.

To confirm eligibility, use the IRS online tools or read the IRS FAQs that accompanied the alert. The IRS page will list exact income brackets and exceptions.

How to check for your 2000 direct deposit

Follow these practical steps to confirm the deposit and act quickly if you do not see the money.

- Check your bank account online and review pending deposits for the expected payment window.

- Allow 72 hours after the IRS batch date before assuming a problem exists.

- Use the IRS online payment status tool, if available, to verify whether your payment was sent and what payment method was used.

What to do if you did not receive the 2000 direct deposit

If the IRS shows a payment was sent but your bank did not post it, contact your bank first. Provide the date and amount so the bank can trace the electronic transfer.

If the bank cannot locate the transfer, you can request a payment trace through the IRS. The trace may take several weeks and typically requires submitting specific details about your account and the missing payment.

Next steps and timelines after the IRS alert

Here is a clear checklist you can follow right now.

- Confirm your bank account on file with the IRS by logging into any IRS account portal you use.

- Keep records of any IRS notices, bank statements, and the exact payment dates mentioned in IRS communications.

- If the payment failed, prepare to claim the credit or payment on your next tax return if the IRS routes unclaimed funds that way.

Practical examples and a short case study

Example steps for someone expecting the payment:

- Check bank transactions daily for the announced batch dates.

- Document any discrepancy and keep copies of IRS notices.

- Contact your bank before contacting the IRS, because banks can often identify holds or pending deposits quickly.

Case study

Maria, a freelance designer, expected the 2000 direct deposit on February 12. She checked her bank online and saw no deposit that day. She waited 48 hours, then called her bank. The bank found a pending ACH transfer dated February 12 that posted on February 14 due to an internal processing delay.

Because she documented the IRS batch date and spoke with her bank, Maria avoided a payment trace and was able to confirm funds two days after the initial batch date.

When to contact the IRS directly

Contact the IRS if:

- Your bank confirms the transfer never reached them and it has been more than 10 business days since the IRS batch date.

- You received an IRS notice referencing a payment that you did not get in any form.

- You believe the IRS sent the payment to an old or incorrect account on file.

When you contact the IRS, have your Social Security number, recent tax return information, and bank statements handy to speed up verification.

Final notes on the 2000 direct deposit IRS alert for February 2026

The key actions are to monitor your bank, verify IRS records, and follow the documented trace process if needed. Most issues are resolved by checking account information and allowing the full processing window to complete.

Keep records, act promptly on discrepancies, and use the IRS tools provided for payment status to reduce delays.