This guide explains the February 2026 $2000 IRS direct deposit: who is eligible, how payments are delivered, how to confirm receipt, and what to do if you don’t get paid. Follow the step-by-step checks and the short checklist to reduce confusion and speed resolution.

What is the February 2026 2000 IRS Direct Deposit?

The February 2026 $2000 IRS direct deposit is a one-time federal payment sent electronically by the IRS to eligible U.S. taxpayers. The payment is deposited directly into the bank account the IRS has on file or an account provided for tax refunds.

This guide covers timing, verification, and common issues to help you confirm the deposit and act quickly if something goes wrong.

Who qualifies for the February 2026 2000 IRS direct deposit?

Qualification depends on the specific program the IRS announced for February 2026. Typical criteria include income thresholds, filing status, and eligibility rules set in IRS guidance.

- Adults who filed 2024 or 2025 tax returns with valid Social Security numbers.

- Those meeting income and dependent rules defined by the program.

- Taxpayers who have direct deposit information on file with the IRS or a linked bank account used for refunds.

Check the IRS.gov news and your account on the IRS portal for the official eligibility list relevant to February 2026.

Key documents to confirm eligibility

Gather your recent tax return, Social Security number, and bank account routing and number. You may also need prior IRS notices or letters that confirm eligibility.

Payment schedule and timeline for February 2026 2000 IRS direct deposit

The IRS typically publishes a payment schedule or approximate window when direct deposits will begin hitting accounts.

- Announcement date: watch IRS announcements in late January or early February 2026.

- Deposit window: deposits often occur over several days or weeks; not everyone gets paid the same day.

- Bank posting: banks may display the deposit as pending before it is available.

Allow 3–5 business days for the payment to appear after the IRS initiates deposits, depending on bank processing times.

How to confirm and track your February 2026 2000 IRS direct deposit

Confirming your payment involves both IRS tools and your bank. Use both to verify that funds were sent and received.

IRS tools to check

- IRS online account: log into your IRS account at IRS.gov to see payments and notices.

- Where’s My Payment or payment lookup tool: this tool shows if the payment was scheduled and the method used.

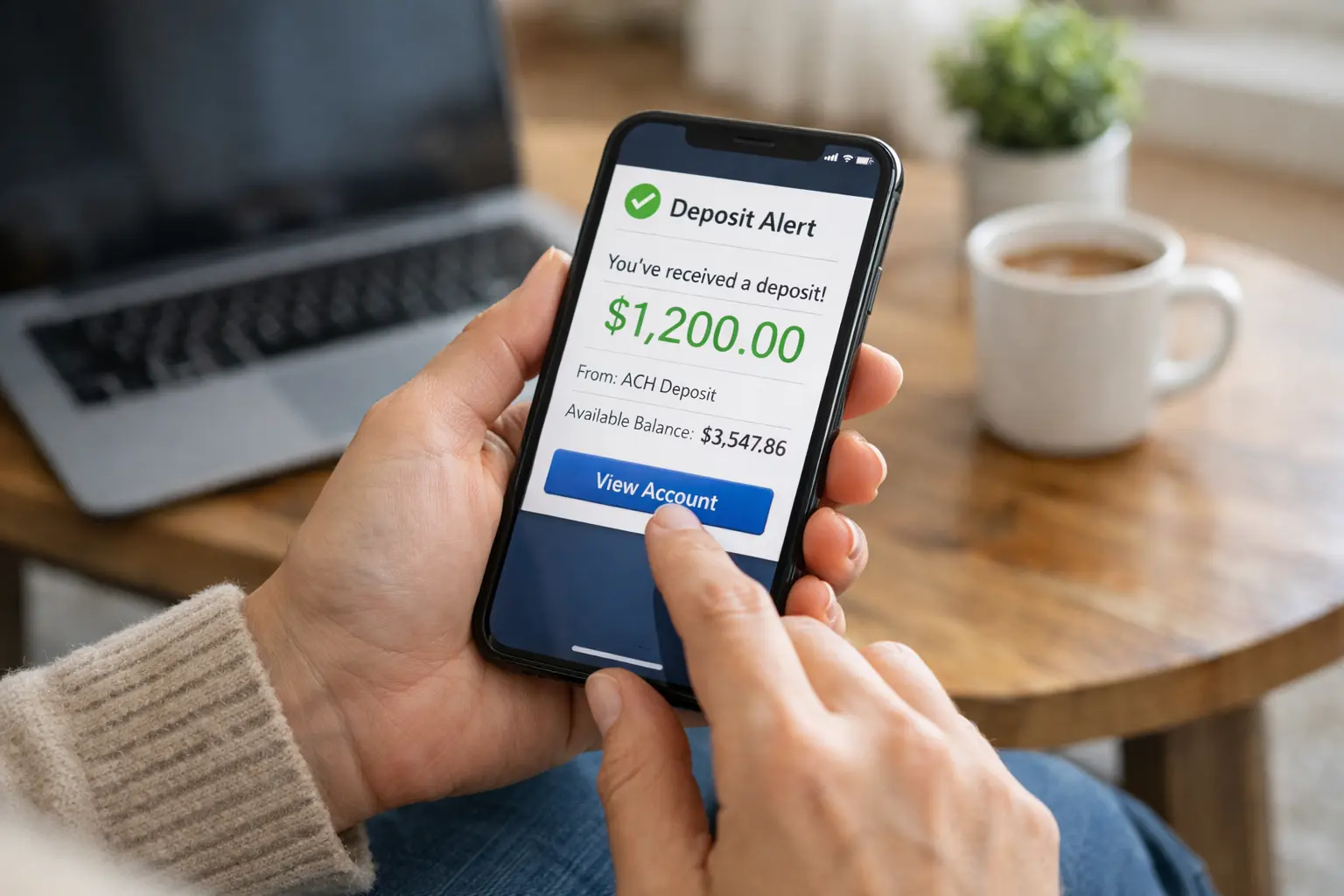

Bank checks

Check your bank app or online banking for deposits. Search for descriptions like “IRS” or “U.S. Treasury.” If your bank lists only a reference number, compare it to any IRS confirmation.

Troubleshooting: If you did not receive the February 2026 2000 IRS direct deposit

If the IRS shows a payment was issued but your bank has no deposit, follow these steps in order to resolve the issue quickly.

- Confirm the payment method and date in your IRS account tool.

- Check account details the IRS has on file—especially routing and account numbers.

- Contact your bank to ask if the deposit is pending or rejected.

- If bank shows rejection or the IRS sent the payment to the wrong account, contact the IRS for next steps.

Keep records of all messages, dates, and reference numbers when you contact the IRS or your bank.

When to contact the IRS

Contact the IRS if at least 10 business days have passed since the IRS marked the payment as sent and your bank has no record. Use the IRS phone lines or secure message within your IRS online account.

Direct deposits normally post faster than paper checks. If you provided bank details on a tax return or refund form, electronic delivery is the quickest option the IRS uses.

Real-world example: Case study

Maria, a single parent in Ohio, expected the February 2026 $2000 payment. She checked her IRS online account and saw a payment scheduled for Feb 12, 2026.

- Feb 12: Bank app showed a pending deposit that matched the IRS entry.

- Feb 13: Funds became available and she received an SMS from the bank.

- If it had failed: she planned to call her bank first, then the IRS with her tax return and account details.

Her preparation (having up-to-date bank info on file and knowing where to check) made verification quick and straightforward.

Quick checklist before February 2026 direct deposit

- Confirm IRS has your current bank routing and account number.

- Verify your mailing address and contact details on the latest tax return.

- Set up an IRS online account and bookmark Where’s My Payment or payment lookup tool.

- Have your 2024 or 2025 tax return handy for identity verification when calling.

- Monitor your bank account daily during the announced payment window.

Final steps and contact resources

If everything checks out and you still don’t see the deposit, contact your bank first and then the IRS. Use secure IRS contact channels to avoid scams.

Keep documentation, check the IRS site for official updates, and use the payment lookup tool before making calls to save time.

This guide gives practical steps to confirm and resolve issues with the February 2026 $2000 IRS direct deposit. Use the checklist and process above to reduce delays and get answers faster.