Overview of IRS 2000 Direct Deposits for February 2026

If you expect an IRS 2000 direct deposit in February 2026, this article explains what to watch for and what to do if a payment is missing. It covers likely eligibility rules, the expected timing, and practical steps to update or check your bank information.

This is a practical guide, not an official IRS notice. Always confirm details on IRS.gov or Treasury announcements for the final schedule and rules.

IRS 2000 Direct Deposits: Who Is Likely Eligible?

Eligibility for any IRS payment usually depends on filing status, income, and prior tax or benefit records. For a hypothetical 2000 payment, common qualifying paths include recent tax returns and benefit records on file.

Common eligibility criteria for IRS 2000 direct deposits

- Filed a 2024 or 2025 federal tax return showing eligibility for a rebate or credit.

- Received Social Security, SSI, or other federal benefit where the IRS or Treasury uses existing payout data.

- Non-filers who registered through an IRS non-filer portal (if offered) and provided bank details.

- Households meeting income thresholds or dependent rules established for the payment program.

Keep documentation like your most recent tax return and Social Security statements handy. These items make it easier to confirm eligibility and to correct records if needed.

IRS 2000 Direct Deposits: Expected Dates and Timing

Payments of this size are typically distributed in batches over several days or weeks. Expect direct deposits to arrive on a rolling schedule rather than all on a single day.

Typical February 2026 timing

- Initial batches: early to mid-February 2026.

- Main distribution: mid- to late February 2026 in multiple waves.

- Final deliveries and mailed checks: late February into March 2026 for those without direct deposit on file.

Note: Exact dates are set by the Treasury and the IRS. Use the IRS payment-status tools or official announcements for precise timing tied to your case.

Rules That Can Affect Your IRS 2000 Direct Deposit

Several rules and routine federal processes can change the amount you receive or whether you receive a deposit at all. Know these to avoid surprises.

Key rules to watch

- Treasury Offset Program (TOP): Federal or state debt such as unpaid child support, past-due federal taxes, or certain federal loans can reduce or offset the payment.

- Bank account status: Closed or frozen accounts will prevent direct deposit and usually trigger a mailed check to your last known address.

- Eligibility adjustments: If IRS records show a change in your filing status or dependency claims, your payment may be adjusted.

- Tax treatment: Verify whether the payment is taxable or non-taxable—check IRS guidance. Historically some rebates were non-taxable, but confirm for this program.

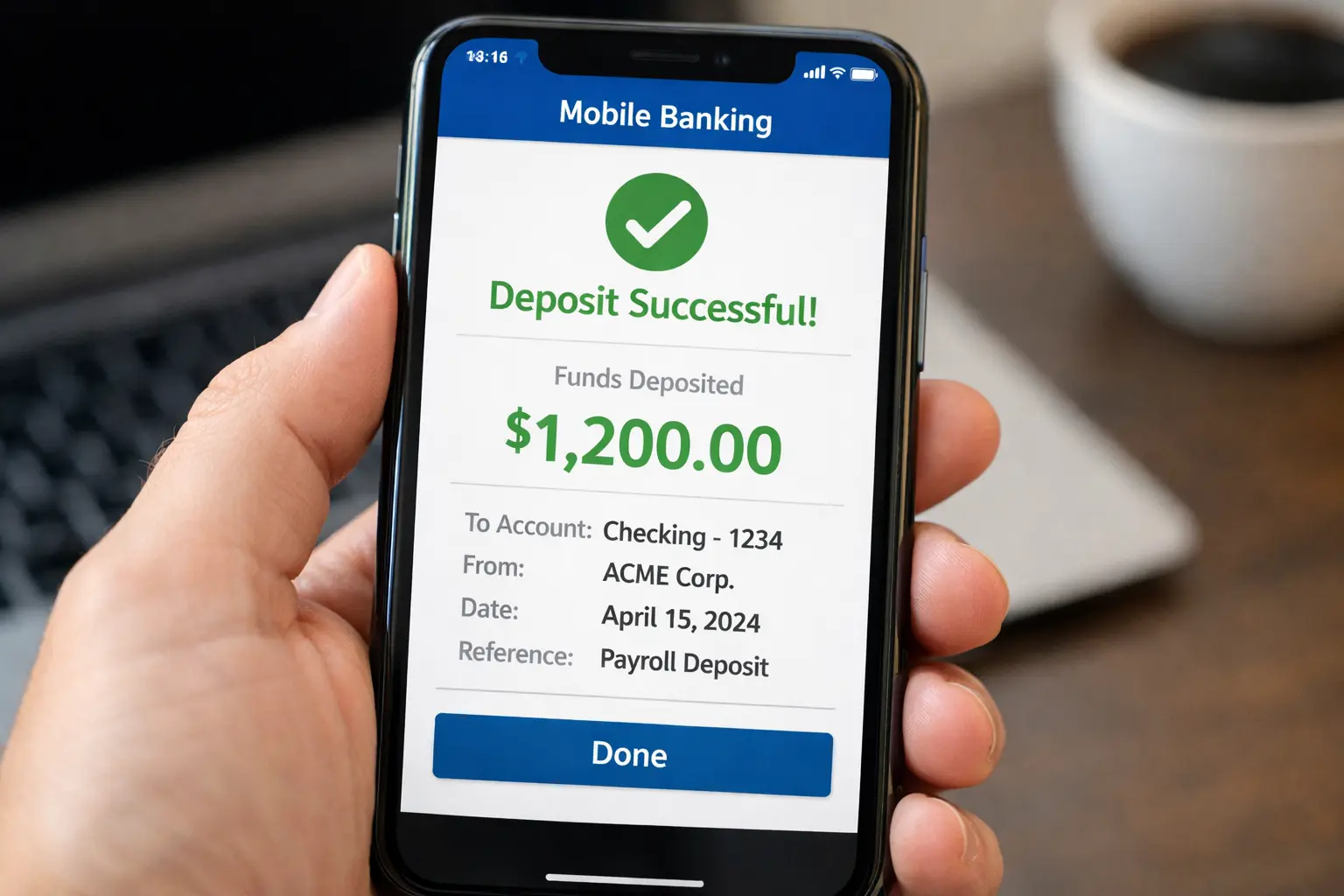

How to Check Payment Status and Update Information

Before payment dates, verify your bank account information and eligibility details. The IRS usually offers an online tool to check payment status for large-scale programs.

Step-by-step checklist

- Confirm your most recent tax return and Social Security records match the IRS files.

- Use the IRS online payment-status tool (if available) to check deposit timing and issue details.

- Update bank account details via your most recent tax return, IRS non-filer portal, or other official IRS methods when allowed.

- If your account is closed, prepare to receive a paper check and verify your mailing address in IRS records.

What to Do If You Don’t Receive an IRS 2000 Direct Deposit

If the expected deposit does not appear, follow a clear sequence to resolve the issue. Acting promptly speeds correction.

Troubleshooting steps

- Confirm the IRS scheduled a payment to you using the payment-status tool or official IRS notice.

- Check with your bank for pending deposits, returned items, or holds placed on your account.

- Look for an IRS letter or notice mailed to your address explaining offsets or adjustments.

- If needed, contact the IRS dedicated helpline during the payment window for program-related questions.

The Treasury Offset Program can take a portion or all of a federal payment to satisfy certain past-due debt, including unpaid child support and some federal taxes.

Real-World Example

Maria, a single filer who submitted a 2025 return, expected the 2000 payment in February 2026. She verified her bank account on the IRS site and checked that her mailing address was current.

When the deposit did not appear in the first wave, Maria checked the IRS payment-status tool and found an offset notice reducing her payment due to an overdue federal student loan. She contacted the loan servicer and the IRS helpline to get details and received a follow-up IRS letter confirming the offset.

By documenting the notices and the dates, Maria was able to reconcile her account records and plan next steps for any remaining balance.

Quick Examples and Reminders

- If you get Social Security benefits and do not file taxes, the IRS often uses benefit records to send direct deposits.

- Non-filers who register through an IRS portal must use the portal before the payment cutoff date to be included in direct deposit waves.

- Always keep your bank and mailing details current with the IRS to avoid delays.

Final Notes on IRS 2000 Direct Deposits

Prepare now by confirming your tax records, bank account details, and mailing address. Use the IRS payment-status tools and official channels for the most accurate information.

Because schedules and rules can change, treat this guide as practical preparation rather than an official schedule. Check IRS.gov for the final announcement and detailed instructions specific to the February 2026 payment program.