The IRS has announced plans to issue $2,000 payments in February 2026 to eligible taxpayers. This article explains who is likely to qualify, the expected dates and delivery methods, and practical steps to check and update your information.

IRS Announces 2000 Payments February 2026: Key points

The IRS message focuses on issuing single payments of $2,000 to qualifying individuals and families. The agency expects a staged rollout in February 2026 that includes direct deposits, prepaid debit cards, and mailed paper checks.

Check your IRS online account or the IRS payment tools for the most up-to-date schedule and guidance. Below are the main items to watch.

Who is eligible for the 2000 payments

Eligibility depends on filing status, income limits, and benefits records. The IRS is using recent tax records and certain federal benefit records to determine eligibility.

- Filed a 2024 or 2025 federal tax return with a valid Social Security number.

- Income below the published thresholds for single and joint filers.

- Recipients of certain federal benefits (Social Security, SSI, VA) may be eligible without filing if the IRS has the required records.

- U.S. citizen or qualifying resident alien status.

People with multiple dependents, recent life changes, or nonstandard income should confirm details because adjustments can affect eligibility.

Common eligibility details

Here are practical eligibility factors to review:

- Adjusted gross income (AGI) limits — check the published thresholds on IRS notices.

- Filing status — single, head of household, married filing jointly, or married filing separately.

- Dependents — some programs phase out by number of dependents or total household income.

- Benefit recipients — the IRS often coordinates with SSA and other agencies to issue payments directly.

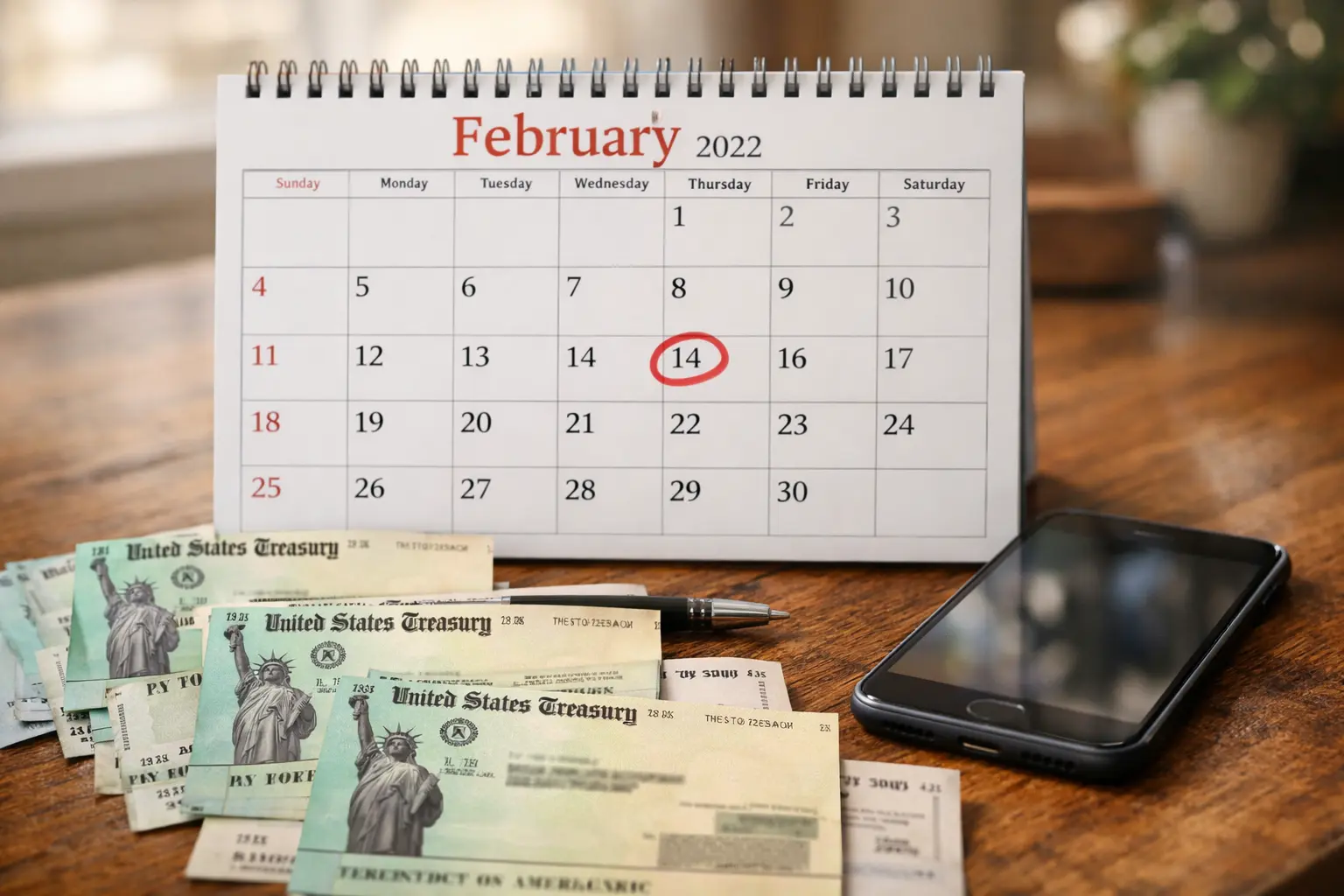

Payment dates and schedule for February 2026

The IRS has provided a general schedule rather than exact delivery dates for every individual. Payments are typically sent in waves based on file processing and direct deposit information.

Expect this general timeline:

- Early February: direct deposit batches to taxpayers with current bank info on file.

- Mid February: continued direct deposits and prepaid debit card mailings.

- Late February: paper checks mailed to addresses on file for those without bank details.

Processing times vary by bank and location. If the IRS does not have your bank account or if direct deposit fails, you will usually receive a mailed check or debit card instead.

How to check a payment date

Use official IRS online tools to check status. Key steps include:

- Sign in to your IRS online account and review “Payment History.”

- Use the IRS payment status tool (if available) or the Get My Payment tool for updates.

- Check mail for official IRS notices that explain timing or next steps.

Many people who receive Social Security or Supplemental Security Income do not need to file a tax return to get payments. The IRS often uses federal benefit records to send eligible payments automatically.

How to confirm your eligibility and update information

Confirm your eligibility by making sure the IRS has your most recent tax return and current bank information. Updating your mailing address is also important if you expect a paper check or card.

Follow these steps to update or confirm your details:

- Create or sign into your IRS online account.

- Verify the bank account listed for direct deposit and update if needed.

- Update your mailing address using the IRS address change process or by filing Form 8822 if required.

If your bank or address changed recently

If you changed banks or moved after your last tax filing, notify the IRS or update your return information as soon as possible. A change after the IRS cut-off may delay delivery or require a mailed check.

What to do if you don’t receive a payment

If you believe you were eligible but did not receive the payment, start by checking online tools and recent IRS notices. Simple issues often explain delays, such as missing bank information or mismatched names and SSNs.

If troubleshooting online does not resolve it, you can contact the IRS by phone or seek help from a qualified tax professional. Keep documentation of your tax filings and benefit records to speed resolution.

Possible next steps

- Confirm filing status and SSN details on your most recent return.

- Check for offset notices — some payments may be reduced for unpaid federal debts.

- If eligible and missed, you may be able to claim a credit on your 2025 federal tax return, depending on the final guidance.

Real-world example: Case study

Maria is a single parent who filed her 2024 tax return and received Social Security benefits for a disabled child. Her bank account was on file with the IRS from direct deposit of a refund.

Because her records matched the IRS criteria, Maria received a direct deposit of $2,000 on February 10, 2026. She checked her IRS account two days earlier to confirm her bank details and address, which helped avoid delays.

In contrast, a neighbor who changed banks in January and did not update the IRS received a mailed check in late February. That neighbor avoided delay by calling the IRS and confirming the mailing address listed on file.

Practical tips before February 2026

- Verify your IRS online account details and mailing address now.

- Update bank information if you prefer a direct deposit.

- Keep copies of recent tax returns and benefit statements handy.

Staying proactive will help you receive the payment on schedule or resolve issues quickly if they arise. For the latest official guidance, always check IRS.gov and authenticated IRS communications.