The VA disability pay increase for 2026 will affect monthly compensation for veterans with service-connected conditions. This guide explains how the amount is set, who is eligible, and when you should expect payments and retroactive adjustments.

VA Disability Pay Increase 2026: What Determines the Amount

The annual VA disability pay increase typically follows the Social Security cost-of-living adjustment (COLA). The COLA is announced by the Social Security Administration in October and is applied to VA rates on an annual schedule.

Key points about how the increase amount is determined:

- The COLA percentage announced for Social Security is commonly used to adjust VA disability rates.

- Your individual pay change depends on your current VA disability rating and any dependents or special monthly allowances you receive.

- Special programs (e.g., Aid and Attendance, unemployability) can affect the total monthly amount after the increase.

Who Is Eligible for VA Disability Pay Increase 2026

Most veterans receiving VA disability compensation are eligible for the automatic increase when rates change. Eligibility hinges on an established service-connected disability rating from VA.

Other eligible groups include:

- Survivors receiving Dependency and Indemnity Compensation (DIC).

- Veterans receiving pension benefits (pensions are also adjusted for COLA in many cases).

- Veterans getting Special Monthly Compensation or Aid and Attendance allowances, which are adjusted along with standard rates.

Payment Schedule for VA Disability Pay Increase 2026

The VA generally updates disability rates once a year based on the COLA. The effective date for new rates is typically December 1 of the year in which the COLA applies.

How payments and retroactive adjustments usually work:

- New rates become effective on the specified effective date (commonly December 1).

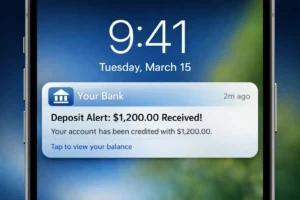

- If the VA applies the increase retroactively, you should receive a lump-sum payment covering the effective date through the end of that month or until normal monthly payments begin at the new rate.

- Monthly payments after the adjustment are paid on the regular VA payment schedule (monthly direct deposit or check), using the new rates.

How to Expect Your 2026 Payment Timing

Expect a lump-sum retroactive payment covering the effective start date to the point monthly payments reflect the new rate. Monthly payments will then continue at the updated rate.

Practical tip: Check your VA eBenefits or VA.gov payment history and your bank account after the COLA announcement and again in the first month the new rates are in effect.

Steps to Check Your VA Disability Pay Increase 2026 Amount

Follow these steps to confirm your new amount and ensure you receive any retroactive pay you are owed.

- Sign in to VA.gov or eBenefits and review your payment history and current compensation rate details.

- Verify your direct deposit information and contact details are up to date to avoid payment delays.

- If you see a discrepancy, contact the VA at the listed phone numbers or file a secure inquiry through your VA account.

Additional actions to consider:

- Update any dependent or household changes that could affect your rate.

- Keep copies of correspondence and pay stubs for your records.

Common Questions About VA Disability Pay Increase 2026

Below are short answers to questions veterans commonly have about the increase.

- Will everyone get the same percentage increase? No. The percentage is the same, but dollar changes vary by individual rate and allowances.

- Do I get back pay? If the increase is applied retroactively, yes — you typically receive back pay for the period between the effective date and when monthly payments reflect the new amount.

- Does the increase affect health care eligibility or copays? Changes in income-based benefits can vary; check VA policy or your local VA office for specifics.

Example Case Study: How a 2026 Increase Affects a Veteran

Example: Maria is rated 70% disabled and receives a base monthly compensation of $1,600 (hypothetical). If a COLA of 3% is announced for 2026, her new monthly amount would increase by about $48 to $1,648.

Maria would typically receive a retroactive lump-sum covering the effective date month at the new rate, plus ongoing monthly payments at $1,648 until the next adjustment. This example is illustrative and uses hypothetical numbers; your actual change depends on your VA rate and allowances.

What to Do If You Disagree With the New Amount

If you believe the VA applied the wrong rate, start by reviewing your VA.gov payment details and the COLA announcement. Keep documentation of your previous rates and any notices from the VA.

Next steps for disputes:

- Contact VA customer service or your regional benefits office to ask for clarification.

- File a formal inquiry or request a review if the issue is not resolved informally.

- Consider seeking help from a Veterans Service Organization (VSO) or an accredited representative to guide appeals or corrections.

Final Checklist for Veterans Before the 2026 Increase

- Confirm contact and bank details on VA.gov.

- Review current compensation rates and dependent records.

- Note the COLA announcement in October and check VA.gov for rate updates afterward.

- Save payment notices and contact your VSO for help if you see discrepancies.

Staying informed and keeping your VA account details current are the best steps to ensure you receive the correct VA disability pay increase for 2026 and any retroactive payments you are owed.