Federal $2000 Deposit Latest Update for January 2025

This article summarizes the latest publicly available information about the federal $2000 deposit as of January 2025. It explains eligibility, the expected timeline, how to verify a deposit, and practical next steps if you do not receive the payment.

What the January 2025 update means

The January 2025 update clarifies whether funds are being issued, who qualifies, and how distributions are handled. Federal payments are normally announced by the U.S. Treasury or the IRS and then implemented through direct deposit or mailed checks.

Because the situation can change quickly, this guide focuses on verifiable steps and official sources to check rather than speculation about future actions.

Who is eligible for the Federal $2000 Deposit?

Eligibility criteria depend on the specific federal program authorizing the deposit. Common factors include income, tax filing status, and benefit enrollment with federal agencies.

- Recent tax filings and adjusted gross income may be used for eligibility calculations.

- People receiving Social Security or other federal benefits may have direct deposit routing already on file.

- Nonfilers sometimes must register with the IRS or a designated portal to receive payment.

Always confirm eligibility details on official government pages to avoid misinformation.

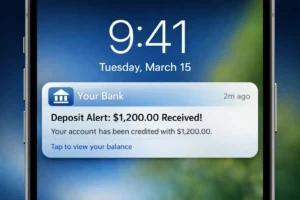

How to check your Federal $2000 deposit status

Use these steps to confirm whether a deposit is expected or has been sent to your account.

- Visit the official IRS or U.S. Treasury website for announcements and payment tools.

- Check the IRS online payment tracker if a tool is available for the specific program.

- Log into your bank account and review recent transactions for an incoming federal deposit description.

- Confirm your direct deposit details on any federal benefit portal you use, like SSA or VA accounts.

Keep records of notices, bank statements, and any IRS correspondence in case you need to verify or dispute a missing payment.

What to do if you do not receive the $2000 deposit

If you expect the federal $2000 deposit but do not receive it, follow a practical checklist to resolve the issue.

- Verify your eligibility and payment schedule on the official announcement pages.

- Check that your bank account and routing numbers on file with federal agencies are correct.

- Search your mail for a check or IRS notice that might explain delays.

- Contact the agency that issued the payment using contact information on their official site.

- Be cautious of scams; do not provide personal information in response to unsolicited calls or emails.

Common reasons a deposit is delayed or missing

Delays are often administrative and can include issues like processing backlogs, incorrect banking details, or eligibility re-evaluations.

- Processing and verification delays at federal offices.

- Incorrect direct deposit information on file.

- Eligibility changes after initial review.

- Mailing delays if a paper check was issued.

Official updates about federal payments come only from government sites such as IRS.gov and Treasury.gov. Social media posts or texts claiming instant eligibility may be scams.

How to protect yourself from scams related to the $2000 deposit

Scammers often exploit high-profile government payments. Use these safeguards to protect your personal information.

- Do not respond to unsolicited calls or texts asking for bank routing or Social Security numbers.

- Verify any email or message with official government portals before taking action.

- Use secure websites (look for a recognized domain like IRS.gov) when checking status.

Timeline expectations for January 2025

Timelines vary by program. If funds were authorized well before January 2025, processing could be underway and deposits may arrive in stages over weeks.

If a program has only recently been authorized, expect additional administrative time for registrations, verification, and distribution planning.

Small real world example

Case study: Jane is a low-income retiree who expected the federal $2000 deposit in January 2025. She followed these steps to confirm and receive her payment.

- Jane checked the official announcement on Treasury.gov for eligibility rules and timelines.

- She verified her bank routing number on file with Social Security and confirmed she had no outstanding eligibility issues.

- When the deposit did not appear, she called the agency using the phone number on their official site and was advised to expect a mailed check due to an account mismatch.

- Jane received a mailed check two weeks later and deposited it via her bank’s mobile app.

This example shows the value of verifying official sources, keeping records, and contacting agencies through published channels when a deposit is delayed.

Action checklist for readers

- Confirm eligibility on IRS.gov or Treasury.gov.

- Check bank account activity and benefit portals for deposit notices.

- Correct banking details with agencies if needed.

- Contact the issuing agency only through official contact information.

- Report suspicious messages to the appropriate fraud hotlines.

By following these steps you can reduce confusion and improve the chance of receiving any authorized federal payment in a timely manner.

Remember that the most reliable information will come from official federal sources. If you are unsure, pause and verify before sharing personal or financial details.