Overview of the IRS Announcement: $1390 Direct Deposit Relief Payment for January 2025

The IRS announced a one-time direct deposit relief payment of $1,390 scheduled for January 2025. This payment targets eligible individuals and households to provide short-term financial support early in the year.

The rest of this article explains who is likely eligible, how the payment will be delivered, when to expect funds, and what steps to take if you do not receive the payment.

Who May Qualify for the $1390 Direct Deposit Relief Payment

The IRS has tied eligibility to recent filings and certain income or credit criteria. Not everyone will qualify, and exact eligibility rules depend on the IRS guidance tied to this relief program.

Common qualifying factors include recent tax returns or benefit records with:

- Valid bank account information on file for direct deposit.

- Income within specified thresholds set by the IRS.

- Recent eligibility for refundable tax credits or similar relief programs.

Key documents and records to check

Before January, confirm you have the right records on file. This speeds verification and delivery of funds.

- Most recent tax return (1040) or IRS account transcripts.

- Bank account and routing numbers used for prior direct deposits.

- Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

How the Direct Deposit Will Be Delivered

The IRS plans to use direct deposit where valid bank information is available. Direct deposit is faster and more secure than paper checks.

If you filed electronically and opted for refund direct deposit in prior years, the IRS will likely use that same account unless you updated it.

Timing and schedule

Payments are scheduled for January 2025. Exact dates will vary by bank processing and the IRS batch schedule. Expect a deposit or a payment notice in early to mid-January for most recipients.

What to Do If You Expect the Payment

Follow these steps before January to reduce delays and address issues quickly.

- Verify your bank account on file with the IRS. Use the IRS online account tool if available.

- Confirm your mailing address if you prefer a paper check and the IRS does not have bank details.

- Watch your bank account and IRS account for messages or notices about the payment.

What to Do If You Do Not Receive the $1390 Payment

If the payment is missing after the expected date, take these steps to troubleshoot and resolve the issue.

- Check your IRS online account for notices or payment status updates.

- Review bank statements for deposits labeled by the IRS in January 2025.

- Contact your bank to confirm if a deposit was returned or rejected.

- If needed, call the IRS help line for payment inquiries and reference the relief payment program.

Common reasons for non-receipt

Non-receipt often happens because of outdated bank details, unmatched identity records, or an IRS processing delay.

- Changed bank account without updating IRS records.

- Missing or mismatched Social Security or tax filing data.

- IRS processing lag due to high volume or verification checks.

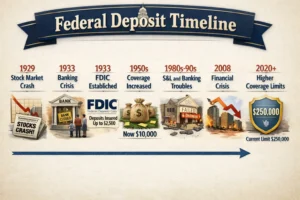

Tax Implications and Reporting

The IRS will provide guidance on whether the $1,390 payment is taxable. Historically, many emergency relief payments are non-taxable, but rules can differ.

Keep documentation of the payment. Save IRS notices and bank statements in case you must report the payment or verify it on a future tax return.

Steps for Low-Income or Unbanked Individuals

If you do not have a bank account, the IRS may send a paper check or offer alternative delivery. Consider these options.

- Open a basic checking account before January to receive direct deposit faster.

- Use community financial centers or credit unions that offer low-fee accounts.

- Watch IRS updates for instructions for unbanked recipients and paper check timelines.

Real-World Example: How the Payment Reached a Household

Case study: Maria, a single parent, filed her 2023 tax return with direct deposit information. She met the income threshold used by the IRS relief program. In mid-January 2025, a $1,390 deposit appeared in her checking account labeled as an IRS payment.

Maria did three things to make the process smooth: she filed electronically, kept her bank account active, and checked her IRS online account for payment updates. When a neighbor did not receive the payment, Maria shared these steps and encouraged them to verify bank details with the IRS.

Frequently Asked Questions About the $1390 Relief Payment

Below are quick answers to common questions about the January 2025 direct deposit.

- When will funds arrive? Expect deposits or notices in January 2025; timing depends on IRS batches and bank processing.

- How is eligibility verified? The IRS will use tax records, benefit records, and other criteria to verify eligibility.

- Is the payment taxable? The IRS will issue formal guidance; save notices and statements for tax records.

Final Checklist Before January 2025

- Confirm bank account and routing numbers with the IRS if you previously used direct deposit.

- Keep your contact and mailing address current with the IRS.

- Monitor your bank account and IRS online account for the payment and notices.

- Prepare documentation if you need to contact the IRS about a missing payment.

This guidance is based on the IRS announcement and typical payment procedures. Check the official IRS website for the most current and official instructions about the $1,390 direct deposit relief payment for January 2025.