The IRS 2000 direct deposit for February 2026 refers to a one-time electronic payment some taxpayers may receive. This article explains who may qualify, how the direct deposit works, timing expectations, and next steps if a payment is missing.

What the IRS 2000 Direct Deposit for February 2026 Means

The IRS 2000 direct deposit is an electronic payment issued to eligible accounts. The payment may be part of a federal program or tax adjustment that the IRS is administering for early 2026.

Direct deposit is faster than paper checks and usually posts to bank accounts the same day it is sent. Knowing the IRS processes and timelines helps you confirm receipt and avoid scams.

Who Is Likely Eligible for the IRS 2000 Direct Deposit

Eligibility depends on the program authorizing the payment. Common eligibility requirements include income limits, filing status, or prior tax filings.

- Recent tax filers who reported qualifying income and banking details.

- Recipients of certain credits or stimulus-type payments who met program rules.

- People the IRS identified using administrative data and authorized lists.

How the IRS Determines Direct Deposit Recipients

The IRS uses tax returns, Social Security data, and benefit records to choose payment recipients. If you previously provided bank routing and account numbers on a tax return or IRS portal, the IRS can use those details for direct deposit.

Timing: When to Expect the February 2026 Direct Deposit

If a payment is scheduled for February 2026, direct deposits typically post on the date the IRS sends the transaction. That date is often a business day and may appear in your account on the same day or within one business day.

The IRS will not always send all payments on the same day. Expect a window of several days or weeks, depending on processing timelines and bank clearing times.

Typical Timeline

- IRS issues payment: payment batch date in February 2026.

- Bank posts deposit: same day or within 1 business day.

- If missed: allow 7 to 14 days before contacting IRS or bank.

How to Confirm the IRS 2000 Direct Deposit Status

Use IRS tools and your bank account to confirm a direct deposit. The IRS may offer an online status tool for program payments; check the official IRS website first.

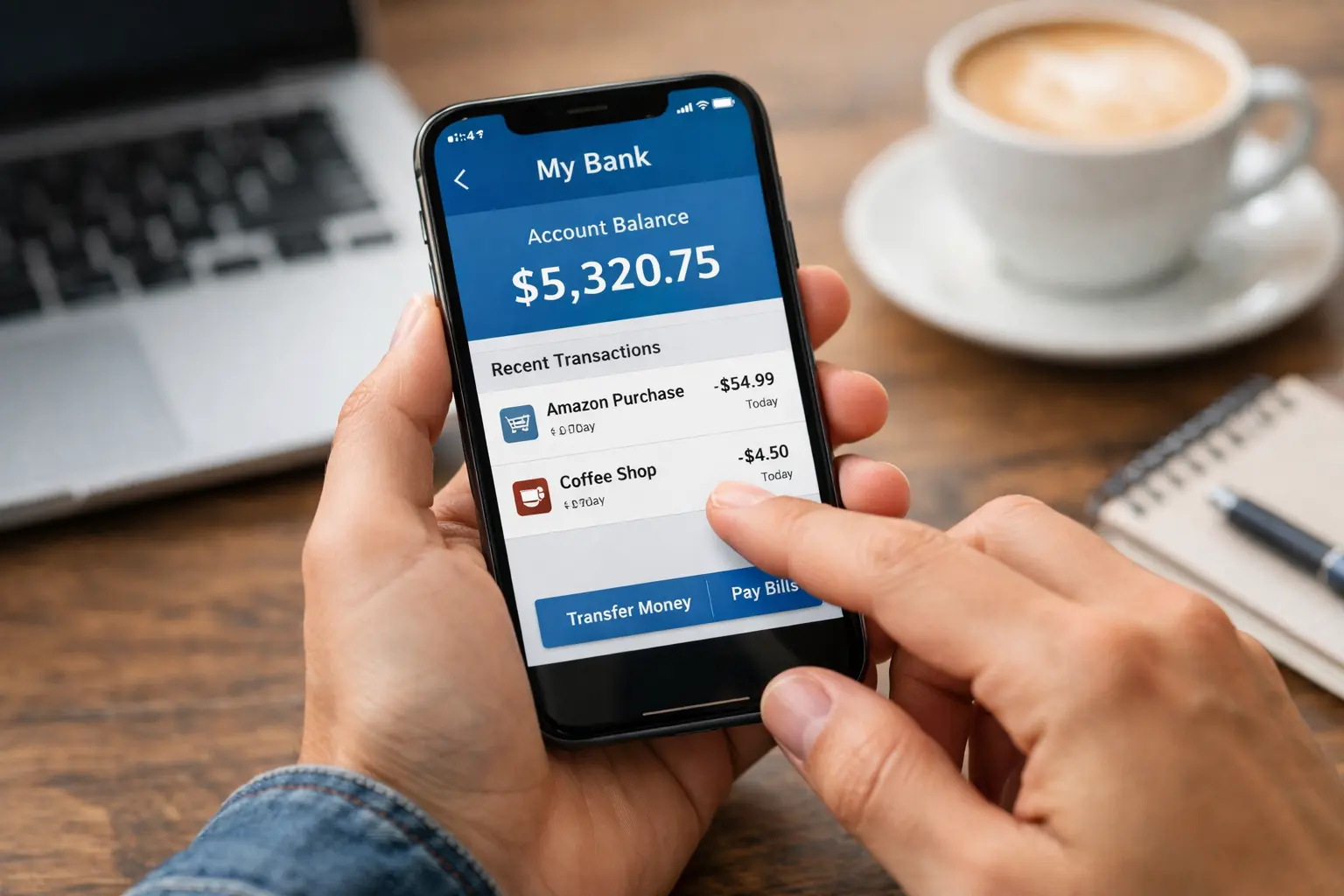

- Log in to your bank or mobile app and check recent transactions.

- Use IRS online tools such as the program status page or your IRS account dashboard.

- Watch your mail for IRS notices that explain payment details or adjustments.

Documents to Have Ready When Checking

- Recent tax return or tax year used to determine eligibility.

- Bank routing and account numbers if you previously supplied them.

- Social Security number and basic identity information for account access.

What to Do If You Don’t Receive the Payment

If you expect the IRS 2000 direct deposit but it does not appear, take these steps in order. Acting quickly reduces delays and helps identify errors.

- Verify eligibility and that you met program rules.

- Check the bank account used on your last tax return or IRS profile.

- Look for IRS notices in the mail about the payment or adjustment.

- Contact your bank to check for holds or returned deposits.

- Use IRS contact options only after confirming bank status and waiting the recommended processing period.

When to File a Claim or Contact the IRS

If a reasonable wait period passes (generally 7 to 14 days) and your bank has no record of the deposit, you can contact the IRS program helpline. Have documentation ready: proof of eligibility, tax return copies, and bank statements.

Common Problems and How to Fix Them

Returned or misdirected payments are often due to wrong account numbers or closed accounts. If your banking details changed since you filed taxes, the IRS may have sent a paper check to your last known address instead.

- Wrong bank account: Provide correct info on your next tax filing or IRS account update.

- Closed account: Bank may return the payment; the IRS typically reissues via mail as a check.

- Scams: Confirm deposit details against IRS notices and do not share sensitive data by phone or email.

Small Case Study: Real-World Example

Case: Maria, a single filer, expected the 2000 deposit in February 2026. She confirmed eligibility based on her 2025 tax return and the portal status. Her deposit posted on February 12 to the account listed on her 2025 return.

Steps Maria took:

- Checked her bank app daily for the two-week window.

- Saved the IRS notice that arrived by mail showing payment details.

- If it had not posted, she planned to contact her bank and the IRS helpline with tax return copies ready.

Tips to Avoid Delays and Problems

- File your tax returns promptly and include accurate bank routing and account numbers if safe to do so.

- Keep your address and contact information current with the IRS and Social Security Administration.

- Use the official IRS website for status checks and avoid sharing personal information outside secure portals.

The IRS often reissues returned direct deposits as paper checks. If a payment is returned by a bank, expect a mailed check within several weeks instead of a second electronic deposit.

Final Checklist Before You Wait

- Confirm you met program eligibility and filing requirements.

- Check bank account listed on your most recent tax return or IRS profile.

- Monitor official IRS communications and use the IRS website for status.

- Contact your bank first, then the IRS if the deposit is not found after the recommended period.

The IRS 2000 direct deposit for February 2026 can be a straightforward electronic payment when your records are up to date. Follow the steps above to confirm eligibility, check status, and resolve issues quickly and safely.