IRS February 2026 Refund Timeline: What to Expect

The IRS February 2026 refund timeline outlines when taxpayers can expect their income tax refunds and the processing stages involved. This guide explains estimated income tax refund dates, common delays, and how to check status so you know when to expect payment.

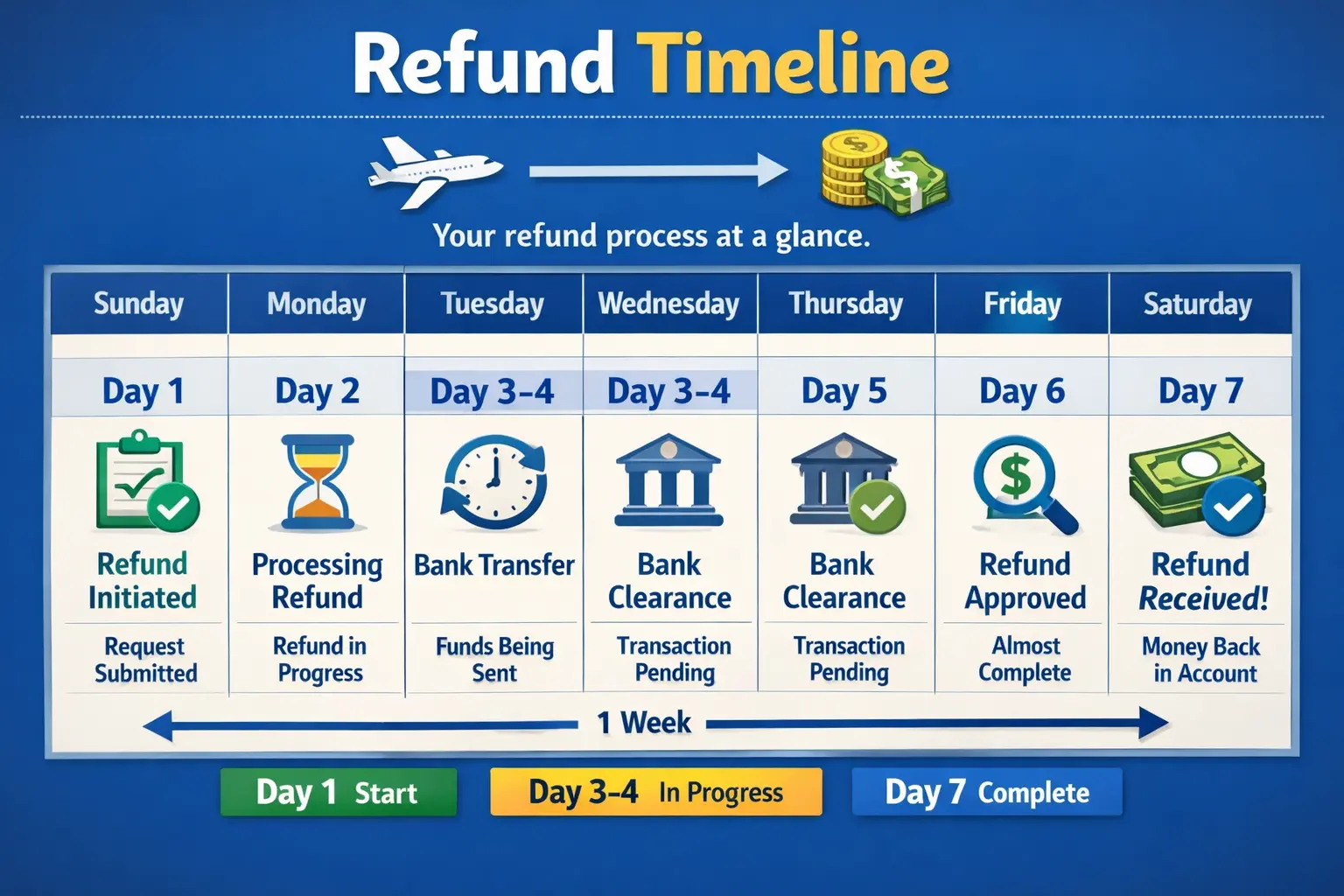

Estimated Income Tax Refund Dates and Stages

The IRS processes refunds in stages: return receipt, initial review, validation, and payment authorization. Most electronic returns with direct deposit move faster; paper returns and checks typically take longer.

Typical estimated income tax refund dates for February 2026 are grouped by filing method and issue date:

- Electronically filed, direct deposit: 7–21 days after IRS acceptance.

- Electronically filed, paper check: 3–6 weeks after acceptance.

- Paper filed returns: 6–12 weeks from IRS receipt.

- Returns flagged for review or identity verification: variable, often several additional weeks.

How the February 2026 timeline works

When the IRS accepts a return, it begins automated checks for errors and fraud. If no issues are found, refunds are scheduled for payment according to processing capacity and bank transfer timing.

Large volumes in February, especially early in the month, can extend processing slightly. The IRS also staggers some refunds to allow for audit and verification work.

How to Check Your IRS Refund Status

Use the IRS ‘Where’s My Refund?’ tool or the IRS2Go mobile app for the most current information. These tools update roughly once every 24 hours, usually overnight.

To check status have ready your Social Security number, filing status, and exact refund amount. These details must match your return for the tool to return accurate information.

Alternative checks and practical tips

- Contact your tax preparer if you used one; they may see additional messages from the IRS.

- Call the IRS only if 21 days (electronic) or 6 weeks (paper) have passed without an update.

- Watch for IRS letters in the mail asking for additional information; responding quickly avoids longer delays.

Factors That Can Delay February 2026 Refunds

Several common issues can push a refund beyond estimated income tax refund dates. Knowing these helps you identify potential problems early.

- Math errors or missing forms. These trigger manual reviews and slow processing.

- Identity verification requirements. The IRS will send a letter asking for documents if identity cannot be verified automatically.

- Claiming certain credits. Earned Income Tax Credit (EITC) and Additional Child Tax Credit (ACTC) claims often delay refunds until mid-February under current rules.

- Offset for debts. Child support, student loans, or tax debts can reduce or offset refunds, reflected in IRS notices.

How to spot a delay early

If the ‘Where’s My Refund?’ tool shows a status of ‘Return Received’ for more than a week, or ‘Refund Approved’ without payment after several days, expect additional processing time. The IRS updates each stage slowly when extra checks are needed.

What to Do If Your Refund Is Late

If a refund is later than the estimated income tax refund dates, follow these steps in order. This reduces unnecessary calls and speeds resolution.

- Verify your return was accepted and that the refund amount you entered is correct in the online tool.

- Wait 21 days for electronic returns and 6 weeks for paper if the tool shows normal processing stages.

- If the refund is still missing, gather IRS notices, your filing confirmation, and bank details before calling the IRS for faster service.

When to contact the IRS

Call the IRS if the recommended wait time has passed or the online tool instructs you to contact them. Be prepared for longer hold times during peak season and phone-based troubleshooting.

The IRS often holds refunds claiming Earned Income Tax Credit or Additional Child Tax Credit until mid-February to allow extra time for validation under current tax law. This is a common cause of February delays.

Real-World Example: A Small Case Study

Maria filed her 2025 joint return electronically on January 28, 2026 and chose direct deposit. The IRS accepted her return on February 2. The ‘Where’s My Refund?’ tool showed ‘Refund Approved’ on February 10, and the deposit posted to her bank account on February 12.

In contrast, John mailed a paper return on January 20. The IRS processed his return and mailed a paper check. John received his check by March 8, which matches the longer paper-processing timeframe.

Quick Tips to Speed Up Your Refund

- File electronically and choose direct deposit to minimize processing time.

- Double-check all Social Security numbers and banking details before filing.

- Respond immediately to any IRS letter requesting documents or verification.

- Avoid last-minute filing errors by using reputable tax software or a qualified preparer.

Following the IRS February 2026 refund timeline expectations and these practical steps will help you set realistic expectations and act quickly if your refund doesn’t arrive on the estimated date. Use the ‘Where’s My Refund?’ tool as your primary source and keep records handy for faster resolution.